BANKS

An afternoon address that shook the markets

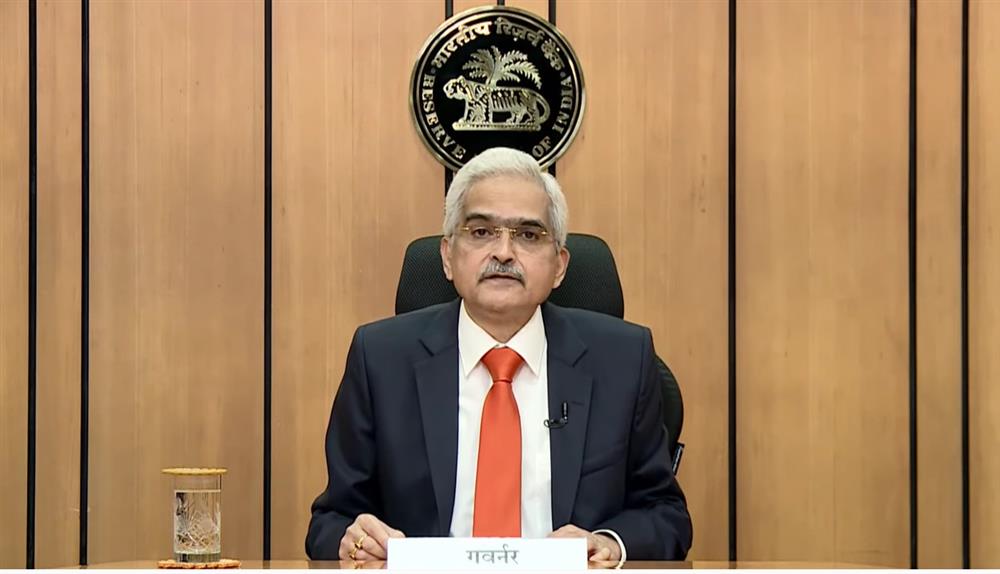

Even as RBI Governor Shaktikanta Das announced a sharp hike in repo rate and CRR, hell broke loose and there was panic selling in the bond and equity markets.

Even as RBI Governor Shaktikanta Das announced a sharp hike in repo rate and CRR, hell broke loose and there was panic selling in the bond and equity markets.

Even as RBI Governor Shaktikanta Das announced in the afternoon of May 4 a sharp hike in repo rate and cash reserve ratio (CRR), hell broke loose and there was panic selling in the bond and equity markets.

In the short end of the bond market, the yields rose by 70 bps while the 10-year benchmark bond rose by 30 bps to 7.40%, its highest since May 2019. The OIS (overnight indexed swap) shorter term bonds of 2-year and 3-year rose by a whopping 40-70 bps as the markets were stunned by the sudden rate change announcement.

“The markets panicked on the timing of the RBI’s rate action. It seemed like a knee-jerk reaction after a long period of rate inactivity,” said a bond dealer who ran up heavy losses on his investments.

The decision also spooked equity investors as the benchmark Sensex ended 1,307 points lower at 55,669 on Wednesday, while the Nifty shed 392 points to close at 16,677.

“The panic in the market was more to do with the timing rather than the quantum of the rate hike,” said PNB Gilts head of treasury Vijay Sharma. “It seemed as if the inflation genie is out of the bottle and everyone had gone horribly wrong in believing that they could tame it. In the next retail inflation print which will be out soon, we expect it to be well over 7%.”

The Reserve Bank of India (RBI) could have prepared the market for a sharp rate hike cycle, like the US Federal Reserve did. The unscheduled announcement in the afternoon created panic in the market. “We were shocked by the sudden announcement and lost heavily in the market. This surprise element could have been avoided and our losses could have come down,” said a bond dealer.

The RBI has also been blamed for neglecting inflation for long while keeping focus on growth. The dilemma of the central bank continued even in its last month monetary policy when commodity prices were ruling high and oil had hit $113 a barrel. The RBI, in fact, was behind the curve and one of its deputy governors feared that inflation targeting could lead to recessionary trends.

“Will central banks overshoot the runway and precipitate an unwanted recession on a world weary with pandemic woes, war and worn and torn supply chains? The dilemma is even sharper for central banks with dual mandates – will their remits allow them to kill the economy for price stability?,” RBI deputy governor Michael Patra said in the minutes of the MPC (monetary policy committee) while finalising the April policy.

Much of the tone changed on May 4 when Das made the announcement of the rate hike at 2 pm. He had already said in the April bi-monthly policy that the RBI would put inflation on priority, but kept the repo rate unchanged at 4%. All were expecting a rate hike but only in the next bi-monthly monetary policy in June.

“As several storms hit together, our actions today (May 4) are important steps to steady the ship. Inflation must be tamed in order to keep the Indian economy resolute on its course to sustained and inclusive growth,” Das said.

Since the April 2022 policy review, the situation, especially on the global and inflation fronts, had gone from bad to worse. There was a spike in the headline CPI inflation to 6.95% in March. The inflation print for April is also expected to cross 7%.

In order to reassess the inflation growth dynamics, the MPC decided to hold an off-cycle meeting between 2-4 May. It was after this that the RBI Governor announced the decision to immediately hike the repo rate by 40 basis points to 4.40% and the CRR by 50 basis points to 4.5% effective 21 May.

The economic situation can turn grave. “The last time the CRR was hiked was in 2010. Even in 2013 during the taper tantrum, there was no CRR hike. When we were unwinding after the financial crisis, the CRR hike happened from 5% to 6%. During the Covid-19 outbreak, the RBI cut the CRR to 3% and then restored it to its earlier level of 4%. In that sense, it is not actually a hike but a restoration. If we have done a CRR hike now, then things are pretty bad,” said a bond dealer working in a brokerage house.

The rate hike announcement by Das came just ahead of the US Federal Reserve policy meeting to initiate the rate hike cycle. “Now with the US Federal Reserve hiking rates by 50 basis points, the RBI would have been seen terribly behind the curve. This explains the sudden announcement of the rate action by the RBI Governor,” said another bond dealer.

The RBI had kept the repo rate unchanged for almost two years and infused huge liquidity into the system to boost growth, which was severely damaged by the coronavirus pandemic, lockdowns and supply-chain disruptions. But inflation was beginning to impact growth.

“There is the collateral risk that if inflation remains elevated at these levels for too long, it can de-anchor inflation expectations which, in turn, can become self-fulfilling and detrimental to growth and financial stability,” Das said.

“I would, therefore, like to emphasise that our monetary policy actions today – aimed at lowering inflation and anchoring inflation expectations – will strengthen and consolidate the medium-term growth prospects of the economy,” he added.

The RBI is expected to come out with a series of rate hikes during the course of the financial year to moderate inflation. This is going to have an impact on the bond market, which was getting used to a long spell of low interest rates.

A day after the RBI announcement, the one-year OIS rose by another 30 basis points to hit 6.02%.The one-year and the two year OIS had earlier gone up by 70 basis points. The rupee closed Thursday marginally weaker at 76.33 a dollar.

The ten-year benchmark bond is expected to trade around 7.5% for now, several dealers said. But on the short end of the market, the rates are expected to rise further.

The bonds on the shorter end of the market will be impacted more than the longer-term ones as the demand and supply mismatches go up, several dealers said.

Treasury profits of banks, which rose substantially when there was surplus liquidity in the market, is also expected to be hit as the RBI follows a policy of quantitative tightening. "The party of surplus liquidity is over. But the ten-year benchmark bond at 7.5% is almost at the same level as the US treasury rates. This may be an incentive for foreign investors to enter and invest," said a senior bond dealer with a public sector bank.

The CRR hike has already tightened the liquidity in the banking system. This has shrunk to Rs 5.2 lakh crore from a surplus of Rs 7.2 lakh crore, putting an end to the easy-money policy that the RBI ran for the last couple of years.