BANKS

CBDCs can make cross-border payments efficient: RBI Guv

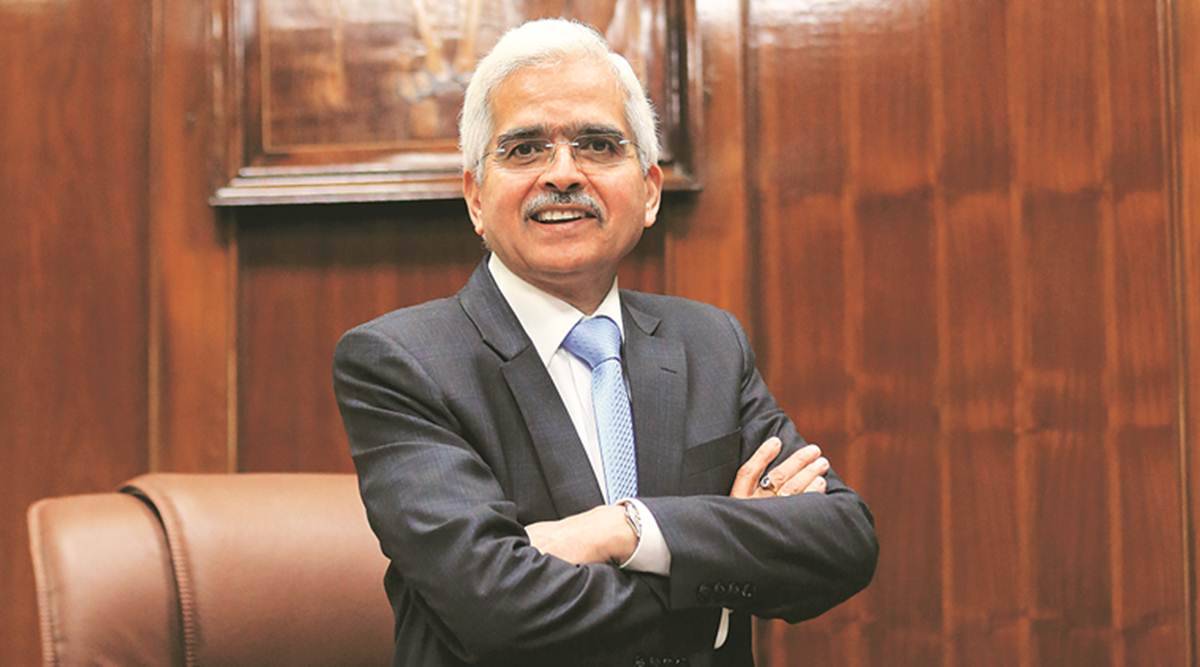

With its instant settlement feature, CBDCs can play an important role in making cross-border payments cheaper, faster and more secure, RBI Governor Shaktikanta Das said.

With its instant settlement feature, CBDCs can play an important role in making cross-border payments cheaper, faster and more secure, RBI Governor Shaktikanta Das said.

The adoption of Central Bank Digital Currency (CBDC), or digital currency, can make cross-border payments more efficient, Reserve Bank of India Governor Shaktikanta Das said.

Stating that several central banks across the world were considering introduction of CBDCs and were taking steps in this direction, Das said that India is “one of the few countries which have launched CBDC pilots in both wholesale and retail segments.”

In November 2022, the RBI launched pilots for digital rupee in the wholesale segment. The retail segment was launched in December 2022.

“Slowly and steadily, we are expanding the pilot to more banks, more cities, more people and more use cases. The empirical data that we are generating would go a long way in shaping the policies and future course of action,” Das said while addressing the G20 TechSprint Finale.

“With its instant settlement feature, I believe, CBDCs can play an important role in making cross-border payments cheaper, faster and more secure,” he added.

The G20 TechSprint event, organised by the RBI and the Bank for International Settlements (BIS) under India's G20 presidency, focused on "Technology solutions for cross-border payments."

Das said the key challenges surrounding cross-border payments continue to be high costs, slow transaction speeds, limited access and insufficient transparency.

“Faster, cheaper, more transparent and more inclusive cross-border payment services would deliver widespread benefits to people and economies worldwide. It would also support economic growth, international trade and financial inclusion,” Das said in his keynote address.

The Governor said three problem statements were identified for this G20 TechSprint 2023, which included reducing illicit finance risk; forex and technology solutions for currency settlement; and technology solutions for multilateral cross-border CBDC platforms.

The first problem statement, Das said, focused on AML/CFT technology solutions that could be integrated into multilateral platforms to reduce the risks of illicit finance, while increasing efficiency of the screening processes for AML/CFT/Sanctions.

“Estimates from the United Nations Office on Drugs and Crime (UNODC) place global money laundering at 2-5% of global GDP, which is about $800 billion to $2 trillion. Other estimates place this closer to $3 trillion, of which, an estimated 3 billion per annum is successfully intercepted,” he said.

“[That is] a very small percentage indeed of 0.1%. It is extremely challenging to achieve full AML/CFT compliance as enforcement is difficult, slow and, at times, only partial. Therefore, it is important to come up with innovative solutions to deal with this major risk to the international financial system,” he added.

Regarding the second problem statement seeking to encourage the participants to come up with technology solutions in forex and liquidity to enable settlement in more number of emerging market and developing economy (EMDE) currencies, Das said the use of local currencies in cross-border payments could help to shield the EMDEs from global shocks, protect against exchange rate fluctuations and encourage the development of local forex and capital markets.

“Multilateral payment platforms that support multiple currencies would offer a way to promote such local-currency payments. As things stand today, FX and liquidity risks associated with EMDE currencies can make the operation of multilateral platforms with EMDE currencies more challenging,” he said.

“It is in this backdrop that effective liquidity mechanisms need to be developed,” he added.

The third problem statement which was intentionally kept broad, called for technology solutions for multilateral cross-border CBDC platforms, he further said.

It invited solutions and technologies for multilateral cross-border CBDC platforms which could contribute to interoperability across multi-CBDC platforms or domestic payment systems; reduce operational cost; and increase efficiency while ensuring consistency in standards across multiple jurisdictions. Das said, “I strongly believe cross-border payments can be made more efficient through adoption of CBDCs and this is an area which should receive close attention.”

“As all of us are starting on a clean slate on the CBDC front. The adoption of right technology platform, which is inter-operable, would be a great benefit to the future of cross-border payments ecosystem,” he added.