The Reserve Bank of India (RBI) has left untouched the key lending rate, or the repo rate, at 4% for the ninth consecutive time while maintaining its stance as ‘accommodative’.

The six-member monetary policy committee (MPC) was expected to move along status quo lines with the Omicron variant posing a threat to normal economic activity and a possible third wave of Covid-19 sweeping the country.

The reverse repo rate, or the borrowing rate, is also kept unchanged at 3.35% and the marginal standing facility (MSF) and bank rate at 4.25%.

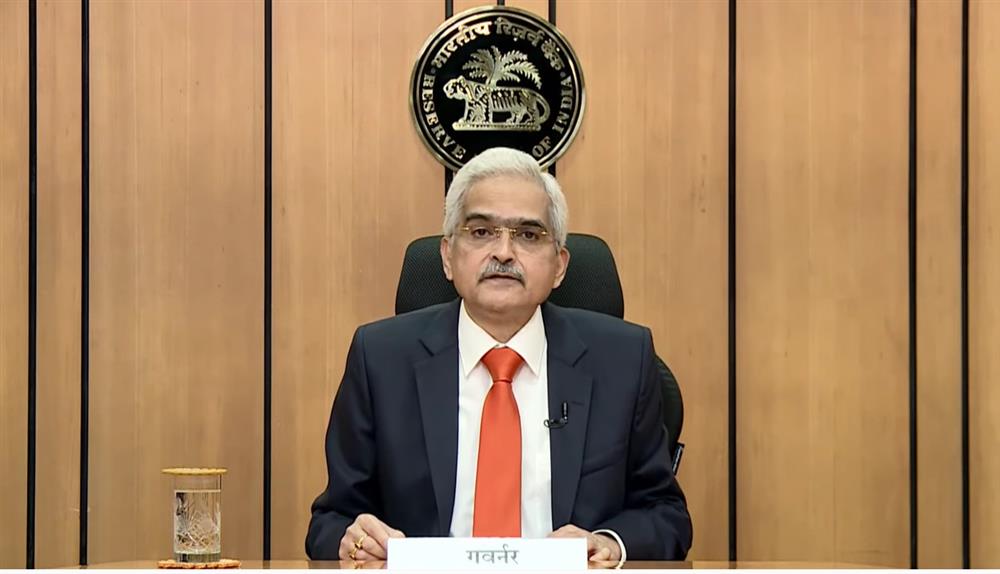

With private consumption still below pre-pandemic levels, RBI Governor Shaktikanta Das said that continued support was warranted for a durable and broad-based recovery.

"The overarching priority of RBI at this stage is revival of growth. Price stability is also our concern, so therefore at this moment, without losing sight on the requirement of price stability, we will concentrate on growth," Das said.

Five MPC members voted in favour of maintaining the ‘accommodative’ stance, he added while announcing the central bank’s bi-monthly policy.

By adopting an ‘accommodative’ stance, the MPC is willing to either lower rates or keep them unchanged.

The RBI has brought down the repo rate, at which the RBI lends short-term funds to banks, by 115 basis points (bps) since March 2020 to cushion the impact of the coronavirus pandemic on the economy.

Inflation projection retained at 5.3%

The RBI has retained its retail inflation projection at 5.3% in FY22 (5.1% in Q3 and 5.7% in Q4) with risks broadly balanced.

Das said price pressures may persist in the near term and sustained high core inflation is a matter of policy concern.

However, the recent cuts in fuel taxes could trigger core inflation to trend lower over the medium term.

RBI expects headline inflation to peak in the fourth quarter of the current fiscal.

Inflation is a matter of concern as it is still away from RBI's ideal rate of 4%. India’s retail inflation rate, which is measured by the Consumer Price Index (CPI), rose to 4.48% in October from 4.35% a month ago.

Price stability remains the cardinal principal of monetary policy as it fosters growth and stability, Das said. The RBI's motto is to ensure a soft landing that is well timed, he added.

GDP projection retained at 9.5% for FY22

India’s GDP grew at 8.4% in the second quarter of FY22 versus a decline of 7.4% in the year-ago period. Economists, however, say that this is largely due to base effect.

The RBI has retained its GDP growth projection at 9.5% for FY22, but revised downwards the fiscal third quarter growth estimate to 6.6% from 6.8% earlier.

The emergence of Omicron has given rise to fears of further restrictions on travel and economic activity, Das said. This has led to "considerable uncertainty on growth dynamics" for the coming months, he added.

Real GDP growth is projected at 17.2% for Q1 and at 7.8% for Q2 of 2022-23.

Balancing Liquidity

Balancing liquidity surplus in the banking system will be a key activity of the RBI even as it has enhanced the quantum of its variable rate reverse repo (VRRR) auctions.

"RBI will continue to rebalance liquidity conditions in a non-disruptive manner while maintaining adequate liquidity to meet the needs of the productive sectors of the economy," Das said.

"The objective is to re-establish the 14-day VRRR auction as the main liquidity management operation," he added.