The Reserve Bank of India (RBI) will engage in gradual, multi-year withdrawal of Rs 8.5 lakh crore excess liquidity in the system which got created out of extraordinary measures taken to handle the Covid-19 stress.

As part of its liquidity management strategy, the RBI has introduced the standing deposit facility (SDF) at an interest rate of 3.75%. The SDF will replace the fixed rate reverse repo (FRRR) as the floor of the liquidity adjustment facility (LAF) corridor. While this is set to suck out excess liquidity in the system, the RBI has also decided to restore the LAF corridor and marginal standing facility (MSF) at 4.25%.

“The SDF rate is tantamount to an indirect tightening of 40bps, as the fixed reverse repo rate stays at 3.35%,” said Radhika Rao, senior economist at DBS.

In 2014, the Urjit Patel committee discussed the SDF as an instrument that helped define a floor rate in the inter-bank market, especially in liquidity surplus conditions. In essence, this allows for the absorption of liquidity from the system without the binding constraint of providing collateral in exchange. The use of SDF will be on the discretion of the banks, in contrast to other instruments like the cash reserve ratio, reverse repo etc which are at the discretion of the central bank.

During the last two years, the RBI offered liquidity facilities worth Rs 17.2 lakh crore, of which Rs 11.9 lakh crore was utilised while Rs 5 lakh crore has been returned or withdrawn so far.

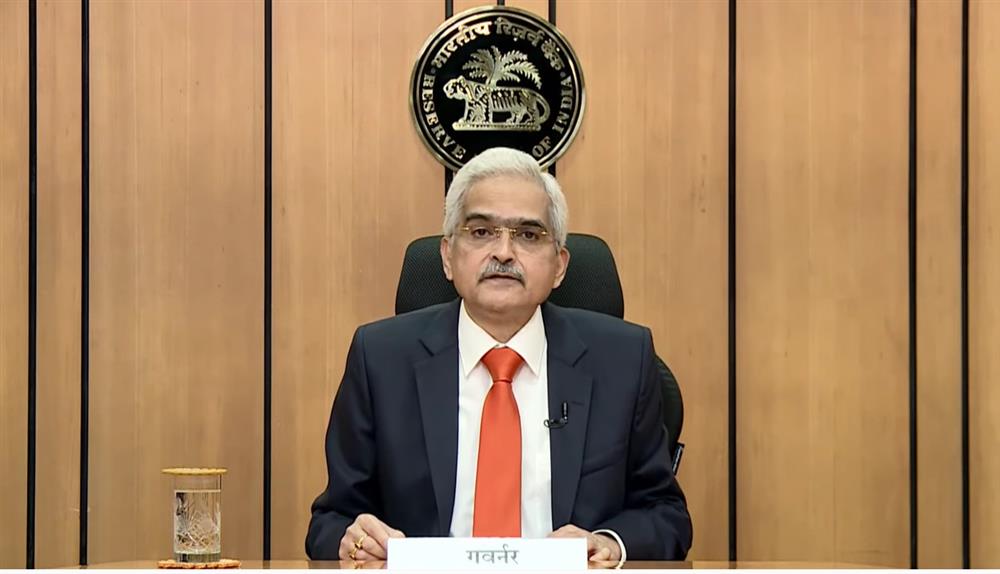

“The extraordinary liquidity measures undertaken in the wake of the pandemic, combined with the liquidity injected through various other operations of the RBI have left a liquidity overhang of the order of Rs 8.5 trillion in the system,” RBI Governor Shaktikanta Das said.

"The withdrawal of liquidity will be multi-year. It can be two years, three years…It will depend on the evolving situation," Das added.

The RBI’s objective is to restore the size of the liquidity surplus in the system to a level consistent with the prevailing stance of monetary policy.

The RBI will continue to adopt a nuanced, nimble approach to liquidity management while ensuring adequate liquidity in the system.

“While doing so, I would like to reiterate our commitment to ensure the availability of adequate liquidity to meet the productive requirements of the economy. We also remain focussed on completion of the borrowing programme of the government and towards this end the RBI will deploy various instruments as warranted,” the RBI Governor said.

During the pandemic in 2020, the RBI widened the width of the LAF corridor to 90bps by asymmetric adjustments in the reverse repo rate vis-à-vis the policy repo rate. The RBI has now decided to restore the width of the LAF corridor to its pre-Covid level through the introduction of the SDF at 3.75%, the policy repo rate being at 4% and the MSF rate at 4.25%.

The RBI has made it clear that it will gradually suck out excess liquidity. At the same time, the liquidity conditions will be kept in surplus and not return to a neutral balance in a hurry, despite inflation concerns.