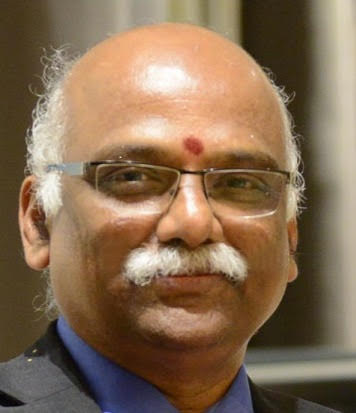

In an interview with Indianbankingnews.com Editor Manju AB, Gandhi, who spent 37 years at the RBI, talks candidly about autonomy, the need for a bad bank and other regulatory issues. Here are the edited excerpts from the conversation.

The Reserve Bank of India (RBI) has been blamed for being late in detecting frauds or red flagging banks even after whistleblowers have complained about lending malpractices.

But former RBI Deputy Governor Rama Subramaniam Gandhi believes this is an unfair comment to make as the regulator has always acted when complaints have been lodged pinpointing specific information. “The first line of defence can’t be the regulator; it will have to be the internal control mechanisms,” he says.

These co-operative banks are small entities operating at a low level of equilibrium. When the things are going well, they are able to sustain. When a small shock strikes them, they don’t have the capacity to withstand.

They do not have the resilience because their capital size is meagre, the area of operations is limited, and their balance sheet size is very small. Large shocks can make these banks tumble.

That is an unfair comment to make. Just because someone makes a complaint does not mean that it will lead to serious actions; it will depend on specific information provided in the letter and not just alleging that the board of directors are not doing their work.

In 2010-11, the information provided was very vague. Nobody had even hinted that there were two sets of accounts. That time the RBI had investigated the matter based on the information that was put on the table. Nothing shocking was discovered.

PMC Bank’s main problem was keeping innumerable secret accounts, which was not being aggregated into the balance sheet. On that there was no whistleblower complaint. It was only last year that the chief executive of the bank revealed the setting up of a series of dummy accounts to mask the large-ticket loans disbursed to a particular group. When the regulator received this complaint, it immediately swung into action.

The RBI can’t take action unless the whistleblower has pinpointed on some specific information. If it is a vague complaint that has been lodged, the regulator will only make a sample check.

In case of ICICI Bank, the allegation was that Chanda Kochhar’s (chief executive of the bank then) family concern received kickbacks for sanctioning money to corporates. From where will the RBI start the investigations? Hundreds of accounts are getting sanctioned by banks every day. It is difficult to nail down graft allegations.

Now with the benefit of hindsight, we can say that there was enough fodder to start an investigation. I will not subscribe to these kinds of tall claims. Vague complaints come very often and most people do not write giving specific details; they indirectly imply something based on nothing concrete. How does the regulator deal with these complaints seriously? When there is a complaint specifying details, they act.

Framing regulations is the fundamental responsibility of a regulator. I don’t think RBI ever considers that task is onerous. However, supervision is a difficult task.

There is a clear understanding across the world that the regulator will not be present all the time to supervise an entity; it can come into play only once in a while to check. The first line of defence cannot be the regulator; it will have to be the internal control mechanisms, the internal audit and supervision by the audit committee of the board. The second level of defence has to be the external auditors.

The RBI has tried to ensure the quality of the auditors. For the schedule commercial banks, the RBI has shortlisted a panel of auditors from where they have to choose from. In case of co-operative banks, the RBI is insisting on a high level of professionalism.

The RBI has created its own internal pool of auditors who undertake mainstream auditing of banks. They hire consultants for IT systems and if there are complex derivative products to be audited, they engage external experts. The core monitoring activity is done by the RBI auditors.

There is no need to regulate the fintech companies directly. The actual lending is done by the non-banking financial companies (NBFCs) or the banks and not the fintech firms. When the fintech companies are only facilitators, why should the RBI regulate them? If the regulator is governing the NBFC or the bank behind the fintech entity, then there is no issue.

There are a number of fintech companies, but not any of them is large. They do not offer the entire spectrum of banking services. So in that sense fintech companies are in no serious competition with the traditional banks. But in the particular segments that they are operating in, they may be giving a tough competition to the banks. If they are offering payment services, for example, the mainstream banks may lose some business in this area.

Earlier, a lot of banks used to make money issuing drafts; that was a good revenue option for them. But now that has come under pressure because of money transfer services.

Fintech companies are offering specific services. Some of them are carrying out very fast credit assessment appraisals. If you want to buy something online on Amazon or Flipkart or any other site, they immediately ask you whether you want to buy it on equated monthly installments (EMI). The EMI channel is still with the NBFC, there is no change in that. But the credit assessment is done for the NBFC by a fintech in matter of a few seconds. This is where banks have to compete.

When it comes to a corporate loan, it is the banks who rule the roost. But all other functions of the bank are being challenged by a fintech.

A committee in the RBI is looking into app-based lending. Only regulated entities should give loans. Amazon or Flipkart is not giving the loan; the real lending is done by the NBFC or a bank. Fintech companies may have ambitions to grow but they need to satisfy the regulatory conditions.

Why are the bankers shocked? The regulations came way back in 2018 and so many cautionary advices were given post that. Action was taken only this year. If the RBI does not take action, then you will ask why the regulator is not enforcing its own instructions.

Initially, Mastercard explained some of the reasons for not being able to comply with the instructions. RBI understood and agreed to give them more time. How long can this be extended? When it became clear that they are only prolonging rather than complying with the regulations, they had to be penalised. If you want to do business, then you need to invest and follow the regulations. Banking is a licenced business; you have to conform to the licensing guidelines.

Mastercard episode may be a temporary advantage to RuPay and Visa. You can’t term it as unfair advantage. The advantage arose because Mastercard did not comply with deadlines given.

If there is a monopoly, the RBI will have regulations. People have to play by the rules. Just to allow competition we cannot allow anyone to operate. Every country takes decisions according to their strategic interests.

The RBI has called for applications. About seven applicants have shown interest. But whether NPCI will be in competition with them or they will have their respective niche areas to occupy we don’t know yet. But it is not necessary that they will have to be in the same space.

The setting up of a special institution to take over large non-performing assets (NPAs) for resolution was needed. The existing asset reconstruction companies (ARCs) are doing the same thing in the sense that they buy the bad assets from the banks and then recover their money either by stripping it or selling it or even reviving it. But the existing ARCs do not have large capital to buy out the big-ticket corporate loans. An institution with deep pockets was needed. The National Asset Reconstruction Company Ltd (NARCL) will initially handle Rs 1 lakh crore of bad loans. Which existing ARC can do this? Besides, resolutions may happen faster because of the NARCL.

The country has decided that these bad loans will have to be resolved. Government guarantee is given for such very large accounts. The existing ARCs are buying relatively small-sized bad loans. They cannot expect government guarantees for the small ticket loans that they buy.

In the case of PMC Bank, it was large scale money diversion and false accounting that led to the collapse. What happened in Yes Bank was large accounts turning into NPAs.

In fact, the comparison is totally unwarranted. Yes Bank’s digital platform was very strong; internet banking had a good technology backbone. The retail and MSME books of the bank were also robust. It is only the large accounts that went bad.

PMC Bank, on the other hand, maintained two account books. You cannot compare the problems of these banks and expect the regulator to have a common response. Each case will be unique and will have to be decided by its own situation. You cannot say that in X bank you did this and the same should be replicated. Each bank will have a different set of issues that will need different solutions.

When a bank is in trouble, the regulator is always on the lookout for a private solution before the public exchequer is called to step in. There were four applications in the case of PMC Bank. The RBI selected the one it thought was practical and implementable. In case of Yes Bank, the RBI came out with a mix of private and public sector banks to rescue it.

This is only an in-principle agreement and is work in progress. The regulator has to first scrutinise if the new promoters are complying with all the demands before handing out the licence for them to start a small finance bank.

Once you are given a banking licence, it is imperative on you to give back the money to the depositors when the deposits mature. Customers cannot ask for their deposits before it matures and the bank cannot refuse the money if it has matured. It is when the bank cannot give out the money that it is put under a moratorium.

When a bank has to be rescued, there will always be an option considered by the new management on what kind of adjustments they need to make. They need to see if the large depositors agree to convert a certain portion of their deposits into equity or into a long term bond or a perpetual bond of five years or ten years. The accumulated interest on these deposits can also be converted into long term bonds.

In the case of Yes Bank, AT1 bonds were written off. So there are many options available. Centrum may be exploring all these options. But finally it requires the nod of the regulator.

There are no impediments to the RBI’s autonomy.

That issue continues. The public sector banks (PSBs) are governed by an Act. The RBI should be given powers to take action against the PSBs. The RBI nominees are there on the boards of all the PSBs, but that isn’t enough. The government is gradually looking into all these issues.