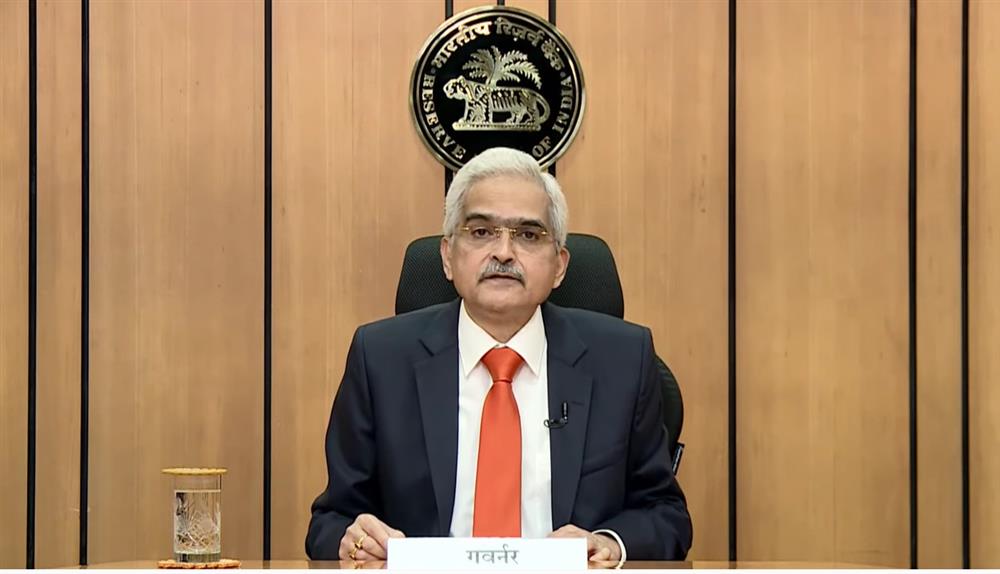

Defending the Reserve Bank of India’s (RBI) handling of the price situation, Governor Shaktikanta Das Wednesday said acting prematurely on inflation by increasing the repo rate at the beginning of the year would have exerted a heavy cost on the economy and citizens.

"We prevented a complete collapse of the economy by keeping rates lower and stayed away from premature tightening," Das said.

The RBI Governor was speaking at the annual FIBAC conference of bankers, a day before the special Monetary Policy Committee’s (MPC) meeting on 3 November to discuss on the report the central bank has to send to the government explaining why it failed to hold inflation within the mandated target of up to 6% for three straight quarters.

“Much has been made about the RBI not being able to adhere to the inflation target, but I would request you to just step back for a moment and think if we had started the process of tightening earlier, what would have been the counterfactual scenario. What you prevent in the process, doesn’t get the kind of appreciation that it should get,” Das said.

Acting early would have exerted costs to the economy and the people. “We prevented a complete downward turn of our economy. After recording a negative growth in the year 2020-21, India’s economy bounced back in 2021-22 and sustained in 2022-23 and also next year. How was it possible if we had prematurely started tightening?” Das said at the event organised by Ficci and Indian Banks Association (IBA).

He said the rate-setting MPC is meeting on Thursday to formulate a response to the government, but defended the RBI's move to not make the letter, to be written to the government, public.

Not making the letter public does not compromise transparency, Das said, adding that nothing in the law gives him the authority, privilege and luxury of sharing privileged communication between the government and the central bank.

He said, the communication which will focus on what led to the consumer price inflation staying above the 6% mark for three consecutive quarters, includes measures which the panel is mulling to take and by when will the price situation come into the 2-6% band.

On rupee depreciation, Das asked everybody not to look at the situation in an emotional manner, asserting that the domestic currency has behaved in an orderly way.

In remarks, that come hours ahead of a review of monetary policy announcement in the US, Das said the US Fed Reserve cannot tighten endlessly and capital flows will eventually resume.

He said the launch of the Central Bank Digital Currency (CBDC) is a landmark moment in the history of currency in the country and will lead to a major transformation of the way business is done.

Retail part of the CBDC trial will be launched later this month, he said.