NEWS

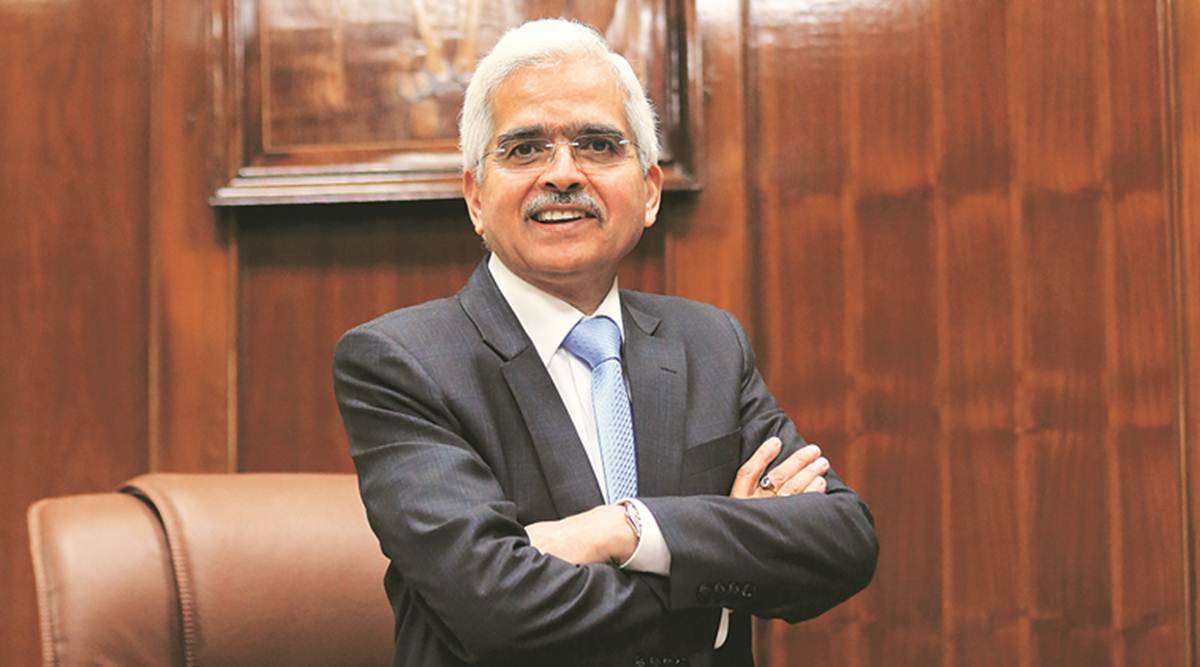

No need for downward revision in GDP growth rate: RBI Guv

RBI does not feel need for downward revision of its 10.5% GDP growth forecast for FY22 despite rise in Covid cases, governor Shaktikanta Das said.

RBI does not feel need for downward revision of its 10.5% GDP growth forecast for FY22 despite rise in Covid cases, governor Shaktikanta Das said.

Despite the rise in new Covid-19 infections, India’s economic revival story will continue unabated as one does not foresee lockdowns, Reserve Bank of India governor Shaktikanta Das said.

RBI thus does not feel the need for a downward revision of its 10.5% GDP growth forecast for FY22, Das asserted.

Speaking at Times Network’s India Economic Conclave 2021, Das said, "We have 'insurance' to protect economic revival like a fast-paced vaccination drive, greater ability among people to follow Covid protocols", and one does not see lockdowns as well.

"The renewed surge in Covid cases in many parts of the country is a matter of concern," the governor said.

"I would feel that the revival of economic activity, which has happened, should continue unabated going forward. My understanding and our preliminary analysis shows that the growth rate next year the 10.5% which we had given would not require a downward revision," he added.

Last year, the central government had imposed a nationwide lockdown amid a surge in Covid-19 caseloads. This had severely impacted the economy and the GDP is forecast to contract by over 7% in FY21.

"...at this point of time, one does not forsee a kind of lockdown that we experienced last year. Last year, it came as a huge shock," Das said.

The governor said RBI was committed to use all its policy tools to facilitate the economic revival from the debilitating impact of the pandemic while ensuring price and financial stability.

Declining to comment on the inflation trajectory, Das said it would be better to wait for the resolution of the Monetary Policy Committee (MPC) early next month.

On the future of the 'V-shaped' growth recovery, Das explained that the RBI had never used any alphabet to denote the recovery but came out with a number, which is being maintained.

When asked about the bond market, Das said the central bank and the market are in no fight. While stating that the relationship should be non-combative, he stressed that the RBI would like for an orderly evolution of the yields curve and no sudden spikes.

The RBI does not want excessive volatilities in the forex market and has been accumulating reserves to protect against the possible impact of the withdrawal of the stimulus measures in advanced economies, Das said.

At present, India's forex reserves are sufficient to cover for 18 months of imports but there is no level of the reserves which the RBI is tracking, Das said while committing to keep the rupee stable.

Das said in the year of the pandemic, India processed 274 crore direct benefit transfer transactions to help the pandemic-affected population.

He said real time gross settlement (RTGS), which is used to transfer large sums of money, has multi-currency capabilities and there is also a scope to explore if its footprint can be expanded beyond the country.

Das said there are no differences with the government over cryptocurrencies and the RBI has conveyed major concerns on the same to the government, which will eventually take a decision on the matter.

Financial sector stability is a major cause of worry which is being assessed as the RBI works on the central bank's digital currency, Das said.