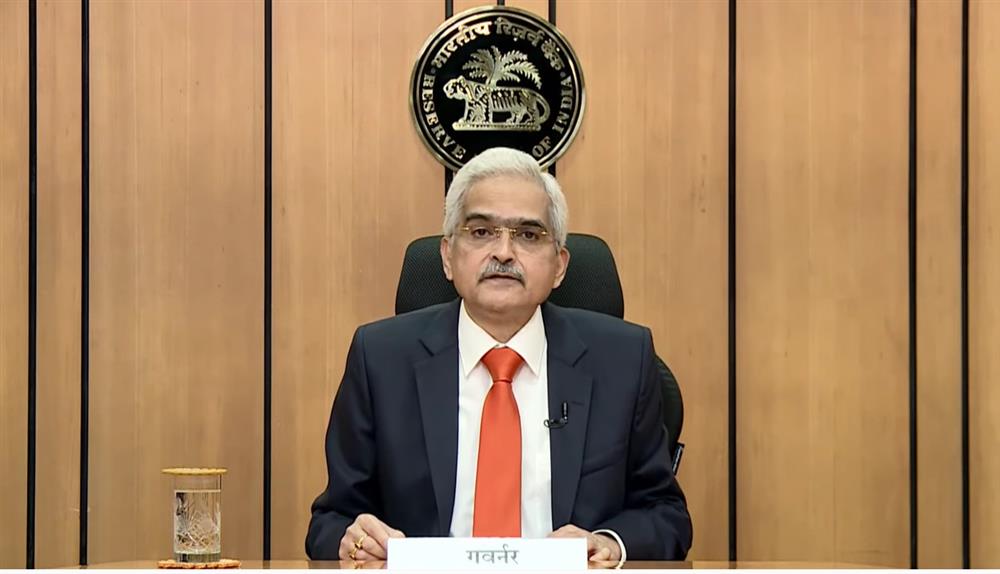

RBI Governor Shaktikanta Das has addressed several issues relating to the withdrawal of the Rs 2,000 banknote, including its legal tender status, impact on the economy, liquidity in the banking system and arrangements made by banks to ensure that inconvenience is not caused to customers.

Das also clarified that the RBI does not have a plan to reintroduce Rs 1,000 bank notes. to ease the impact following the withdrawal of Rs 2,000 notes,

Interacting with the media on Monday for the first time since the announcement of withdrawal of Rs 2,000 notes, this is what Das had to say:

No need to rush to the banks – The Reserve Bank of India (RBI) has given more than a four-month window to exchange the Rs 2,000 notes. The exercise starts from 23 May and ends on 30 September.

The deadline is only to streamline the process and the RBI will be sensitive to all issues cropping up in the process, if any.

"We have more than adequate quantities of printed notes already available in the system, not just with RBI but with currency chests operated by banks. We have sufficient stocks, there is no need to worry," Das said.

Most of Rs 2,000 notes to return to banking system – The RBI expects most of the Rs 2,000 notes in circulation to come back to the exchequer by 30 September.

Continue to be legal tender - The decision to withdraw Rs 2,000 from circulation is part of the currency management operations of the RBI and is in tune with the clean note policy.

The Rs 2,000 notes continue to be legal tender.

Indian currency management system is very robust, the exchange rate has remained stable despite crisis in financial markets due to war in Ukraine and failure of certain banks in the West.

Why give 30 September deadline – Unless you give a particular time, the process will not reach the stage of finality. You have to give a time so that the announcement is taken seriously. The banks have been advised to make necessary arrangements to ensure that people don't have to stand in this scorching heat.

"Take your time. The process is starting tomorrow but you don't have to go tomorrow," Das said.

Purpose of Rs 2,000 fulfilled - The Rs 2,000 notes were introduced to primarily replenish the currency that was withdrawn (all Rs 500 and Rs 1,000 banknotes) following 2016 demonetisation and the purpose has been fulfilled.

Impact on economy - The impact of the withdrawal on the economy will be "very very marginal". The Rs 2,000 currency notes make up for just 10.8% of the total currency in circulation.

Pan required for deposits of Rs 50,000 upwards - Existing income tax requirement of furnishing PAN for deposits of Rs 50,000 or more in bank accounts will continue to apply for deposits of the withdrawn Rs 2,000 notes.

Liquidity - Liquidity in the system is being monitored on a daily basis.

Security features of Rs 2,000 not breached – The security features of the Rs 2,000 note have not been breached.

No plan to reintroduce Rs 1,000 notes - The RBI does not have a plan to reintroduce Rs 1,000 bank notes to ease the impact following the withdrawal of Rs 2,000 notes.

“There's no such proposal right now," Das said.