State Bank of India (SBI), Bank of India and other lenders have hiked their lending rates while ICICI has also upped deposit rates, indicating northward movement of interest rates on both sides of the spectrum amid tightening of monetary policy by the Reserve Bank of India (RBI) to tame inflation.

Even mortgage lender HDFC Ltd has raised its lending rate by 50 basis points . Other financial institutions and banks are expected to also increase their lending rates.

Interest rates on deposits will, however, not be increasing as much as lending rates as banks enjoy some element of liquidity even now. Depositors will get positive rates higher than inflation only when banks are exhausted of liquidity. Things could turn only next year, some analysts said.

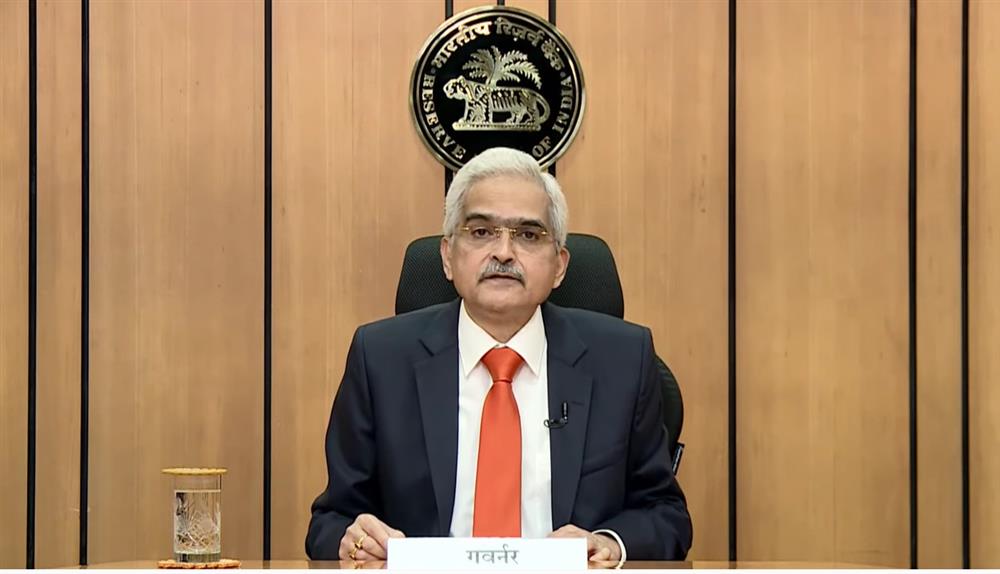

The RBI on Friday announced a 50-basis point hike in repo rate to 5.9%, a move which would increase EMIs (equivalent monthly instalments) for housing, vehicle and other loans as cost of funds go up for banks and other lending companies.

Depositors are hoping that they would earn higher from savings, which have gone up in recent months but still fall short of rate of inflation.

That home loans will get dearer is already signaled by leading housing finance provider HDFC, which upped its lending rate after the RBI hiked the policy rate in its Monetary Policy Committee (MPC) for the fourth straight time since May. In the last five months, HDFC has introduced seven rate hikes. The total increase carried out by HDFC in this span is 1.90%, which is in line with the RBI's rate hike.

With home loans turning costlier, residential sales could get impacted, particularly in the affordable and mid-range housing segments.

HDFC’s new rates come into effect from 1 October. "HDFC increases its Retail Prime Lending Rate (RPLR) on housing loans, on which its Adjustable Rate Home Loans (ARHL) are benchmarked, by 50 basis points, with effect from October 1, 2022," the company said.

HDFC offers home loans starting from 8.10% per annum. Both new and existing borrowers will now need to make EMI payments that are 0.50% higher.

SBI raised the external benchmark based lending rate (EBLR) and repo-linked lending rate (RLLR) by 50 basis points. This has elevated the EBLR to 8.55% and the RLLR to 8.15%, effective 1 October. Banks add credit risk premium (CRP) on top of their benchmark rate while giving loans. So for those borrowers who have availed loans based on EBLR and RLLR, EMIs will go up.

Bank of India has increased its effective RBLR to 8.75%. This comes into effect from Friday, the day RBI announced its rate hike.

Private lender ICICI Bank has raised its effective benchmark lending rate to up to 9.60%.

On the deposit side, ICICI Bank has hiked interest rates. The new rates for fixed deposits of less than Rs 2 crore come into effect from 30 September.

ICICI Bank raised interest rates on fixed deposits maturing in 1 year to 2 years by 20 basis points, from 5.50% to 5.70%. For term deposits maturing in 2 years 1 day to 3 years, the rates are up by 20 basis points, from 5.60% to 5.80%.

Fixed deposits maturing in 3 years, 1 day to 5 years will continue to pay 6.10% interest, while term deposits maturing in 5 years, 1 day to 10 years will fetch 6% interest, up from 5.90% before. The bank will continue to provide an interest rate of 6.10% on 5 years (80C FD).

The private lender increased the interest rate on fixed deposits maturing in 7 days to 29 days by 25 basis points, from 2.75% to 3%. The interest rate on term deposits maturing in 30 days to 90 days increased from 3.25% to 3.50%. Fixed deposits with maturities between 91 and 184 days will now earn an interest rate of 4.25% (up from 4% previously), and term deposits with maturities between 185 and less than a year will now offer an interest rate of 4.90%, up from 4.65%.

“ICICI Bank offers interest rates as high as 6.60% p.a. for senior citizens (above the age of 60 years) and up to 6.10% p.a. for citizens below age of years. With the current uncertainty and highly volatile market, you can always rely on ICICI Bank’s fixed deposits for assured and guaranteed returns,” the lender’s website stated.

ICICI Bank Golden Years FD interest rates are also effective from 30 September. A special retail term deposit offered by ICICI Bank called the "Golden Years FD" gives resident senior citizen customers an additional 0.10% in interest over and above the existing additional rate of 0.50% per year.