Are we headed for an interest rate reversal with the Reserve Bank of India (RBI) pressing the pause button for the second consecutive time this financial year after raising them six times in a row?

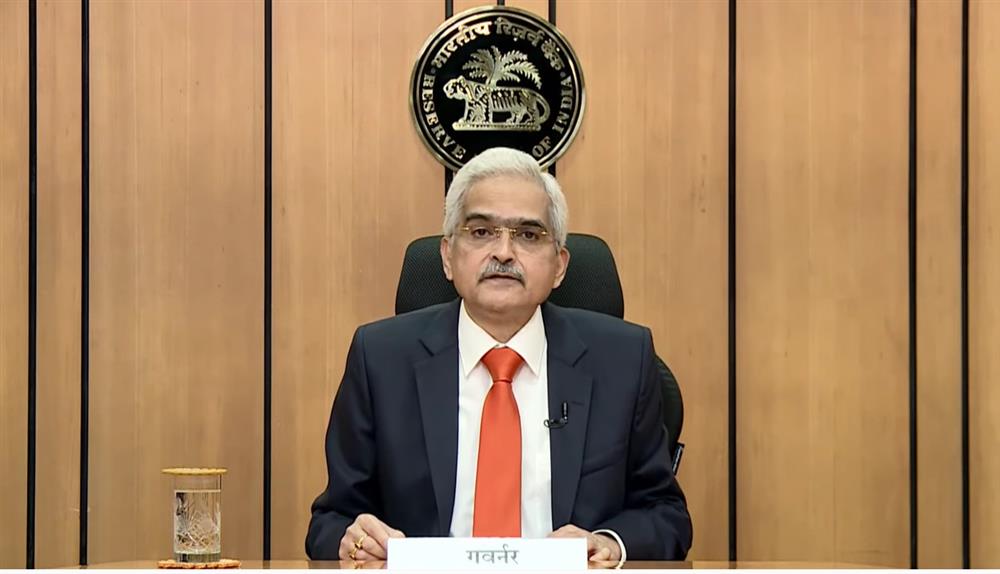

There is no reason to believe that RBI Governor Shaktikanta Das along with the monetary policy committee (MPC) will go for a rate cut any time soon. Das has avoided providing any guidance but if there is any reference point to follow, it is that provided by US Federal Reserve Chair Jerome Powell when he said rate cuts could be "a couple years out".

While the RBI has preceded the Fed in pausing rate hikes, taking a bet on rate cuts is some time away and could possibly stretch to the next financial year. Among other things like the external environment, the RBI has to also look at providing adequate rate differential to make foreign portfolio flows attractive.

Das will continue to guard inflation, as he has done so far since May 2022 when he started the rate increase cycle to wrestle rapid price rise amid global geopolitical tensions and an unending war in Ukraine. All this while he followed the US Federal Reserve to push repo rate up by 250 basis points to 6.50%. But in April he decided to change track and skipped a rate increase amid moderation in inflation.

Das felt that domestic conditions were favourable for the RBI to continue with the 'rate skip' in the next bi-monthly monetary policy earlier this month. A week later, the Fed announced a pause in interest-rate hikes after raising them 10 times in a row.

The stance of Das and his team was further vindicated when government data, released days after the monetary policy announcement on 8 June, showed that India’s retail inflation had cooled to a 25-month low of 4.25% in May, from 4.7% a quarter ago and 7.04% a year ago. A wide section of economists believe that consumer price index (CPI) inflation will again print below 5% in June.

So, will Das take the bold step of lowering interest rate?

As much as he may like to cut rates for borrowers to aid growth, Das faces the reality of India sharing an inflation problem with the world. The global supply chain is in disruption since China’s withdrawal, and the issues are not going to fade away any time soon. The war in Ukraine is also not going to stop and fuel-driven inflation is going to keep coming back from time to time to hit a range of economies across the world.

There is another issue at home. India will hold polls in a number of states and the general election is due early next year. Apart from the economic requirement, there will be political pressure to keep inflation low while ensuring that growth takes place.

While a long pause in interest-rate hikes is possible with inflation moderating, it does not signal a change in RBI’s policy and a movement towards rate cuts. India is better poised than the others to report faster growth but can’t remain isolated from global headwinds. Inflation’s staying power is going to remain a worry point for central bankers across the world. Even with the pause, Fed officials have hinted at lifting interest rates twice by the end of 2023.

For Das and the team at RBI, fighting the inflation battle is far from over. Das recently said at an event in London that the disinflation process in India is likely to be slow and protracted and the pause opted for in April and June meetings by the MPC “is not a pivot”.

The RBI is using the pause period to assess the impact of its past rate hikes. “A pause will allow for the lagged impact of past hikes to filter through to the real economy, with policymakers keen to keep real rates in positive territory. Liquidity swings will be met via need-based money market operations rather than durable tools,” said Radhika Rao, executive director and senior economist at DBS Bank.

The RBI has projected inflation to fall to 5.1% in 2023-24, but this is still well above the target of 4%. As per RBI’s current assessment, convergence to the inflation target of 4% would be achieved over the medium-term.

Growth concerns are also important in a socially diverse economy like India. “Given our population and large addition to the work force every year because of the demographic dividend, we cannot be oblivious to growth concerns,” Das said.

The RBI has projected GDP to grow 6.5% during 2023-24 compared to 7.2% a year ago.

Several economists are speculating that the RBI would take an extended pause and an interest-rate cut could happen only towards the end of this calendar year or next year.

Aditi Nayar, chief economist at ICRA, believes rate cuts are still distant. “We expect an extended pause through 2023-24 and the stance to remain unchanged over the next couple of bi-monthly policy reviews,” she said.

Dharmakirti Joshi, chief economist at Crisil, expects a rate cut towards the end of FY24. “We expect RBI to maintain status quo on rates this fiscal and initiate cuts in the January-March quarter of 2024,” he said.

However, the progression from pause to interest-rate cuts will depend on a lot of variables, including inflation in India and in developed countries. The prediction of an end to the rate hike cycle is also fraught with risks, though the popular view is that the RBI will adopt a pause policy for long.