BANKS

Rate cut unlikely in FY24 as RBI revises inflation forecast

There are enough indicative trends to show that RBI is most unlikely to go for an interest-rate cut in the current financial year.

There are enough indicative trends to show that RBI is most unlikely to go for an interest-rate cut in the current financial year.

The Reserve Bank of India (RBI) will most likely not go for an interest-rate cut in the current financial year. There are enough indicative trends showing which way the wind is blowing.

The steep rise in some of the vegetables, including tomatoes, has shown that inflation will be high in July and August at the least. The RBI has already raised its inflation forecast from 5.1% to 5.4% for FY24, with Q2 at 6.2% and Q3 at 5.7% before it slides to 5.2% in Q4. The achievement of 4% target in a stable and durable way is miles away. And the central bank has made its forecasts assuming that we will have normal monsoons.

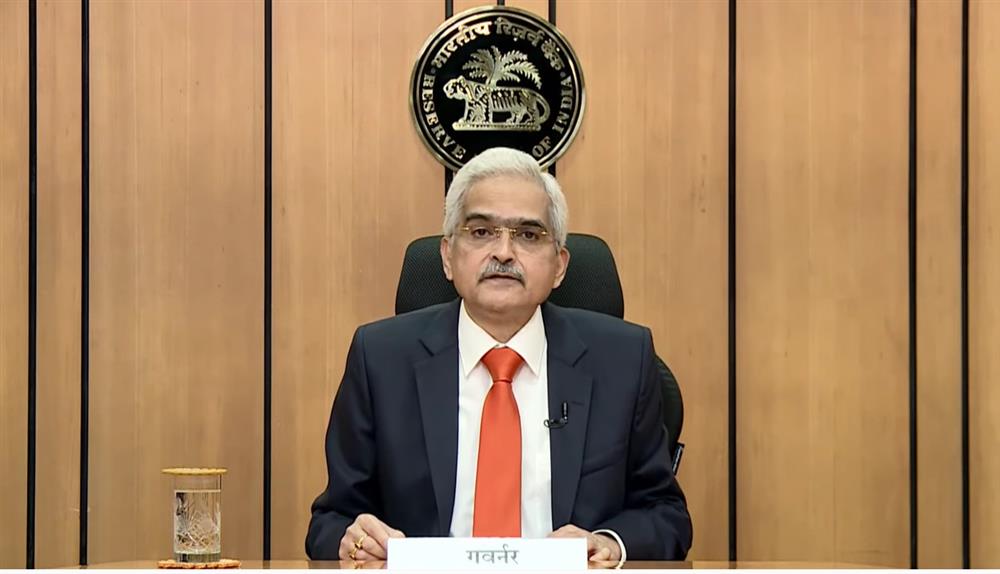

Even if a normal monsoon is on the cards, there is concern about the El Nino effect on uneven rains and our crops. The RBI Governor, Shakikanta Das, has admitted of uncertainties remaining on domestic food price outlook due to sudden weather events and possible El Nino conditions in August and beyond.

The price shock on vegetables may see significant correction after a few months. But after tomato, speculation is that onion prices may shoot up. Food inflation is under pressure from wheat as well while rice is facing ban on exports. The price of cereals will be better known in September. If rains are affected in August due to El Nino, there will be more uncertainty on food price behaviour. Fertiliser prices have also gone up.

The worry from external headwinds is less now but can come at any time with renewed force. Das has expressed caution while stating that the Indian economy is more resilient to withstand global headwinds far better than many other countries. “Global food prices are exhibiting a hardening bias on renewed geopolitical tensions. Crude oil prices have firmed up in recent weeks and its outlook is clouded by demand-supply uncertainties,” he said.

Indianbankingnews.com had argued earlier after the June monetary policy announcement that an interest rate reversal is not going to come any time soon. There was hope among many that a rate cut could follow probably in the fourth quarter of the fiscal after the central bank pressed the pause button on interest-rate hike for the second time after raising them six times in a row, but we did not agree.

Our argument then was that while a long pause in interest-rate hikes is possible with inflation moderating (at that time), it did not signal a change in RBI’s policy and a movement towards rate cuts. The reality is that India is sharing an inflation problem with the world.

There are steps that the RBI has taken in its August monetary policy that indicate that a rate cut is most likely not on the horizon in the current financial year and could possibly stretch to the first quarter of the next fiscal, depending on the data that prevails at that time.

First and foremost is the revision in inflation projection for FY24, emphasised by the RBI Governor when he said that certain developments like uneven monsoons warrant “a heightened vigil on the evolving inflation trajectory".

The RBI also believes that inflation at the revised rate will not bring down its earlier projected growth levels for the Indian economy. The central bank has retained India’s GDP growth for FY24 at 6.5%. This optimism springs from several quarters. “Investment activity has gained further steam on the back of government capital expenditure, rising business optimism and revival in private capex in certain key sectors. Continued increase in import and production of capital goods further reaffirms this trend. Construction activity also remained strong in Q1 as indicated by healthy growth in cement production and steel consumption,” Das said in his policy statement.

The Reserve Bank has also made it clear in its August policy that surplus liquidity in the system would bother the central bank while it would continue to maintain “adequate liquidity”. Asking banks to hike incremental cash reserve ratio (CRR) to 10% is how the RBI wants to suck out over Rs 1 trillion from the system.

While there is no assurance when a rate cut is going to come, an increase in interest rate is not ruled out. If inflation rises to an uncomfortable level, the RBI will step in to hike repo rate to beyond 6.50% after pausing it for the third time in a row. The government may want interest rates to drop ahead of the general election due in April 2024, but the inflationary headwinds may not allow the central bank to take such a step. The six-member rate-setting monetary policy committee (MPC), while voting unanimously to keep the repo rate unchanged, has said that it is prepared to act should the situation so warrant.

“We need to wait and watch as to how the RBI looks at liquidity next month when a review is done. There is an assurance that the central bank will ensure that liquidity is available during the busy season. But for sure, we cannot expect any repo rate cut this financial year – a rate hike too cannot be ruled out if inflation surges past 6% on a continuous basis,” said Jahnavi Prabhakar, economist at Bank of Baroda.