Why did the Reserve Bank of India (RBI) press the pause button on interest rates when the wide market expectation was another hike of 25 basis points?

Despite RBI adopting a 'pause' policy this time, there is a strong possibility that interest rates would continue to climb. Liquidity is getting tighter and bank deposit growth is sluggish. Though the interest rate transmission is complete only on home, vehicle and personal loans that are linked to the external benchmark like the repo rate, in other products there is still ground to cover.

Bankers said in loan products linked to the MCLR (marginal cost of funds-based lending rate), the rate hike transmission is still taking effect. Since May 2022, the RBI has raised the repo rate by 250 basis points to 6.50% but banks have not entirely transmitted this across their loan products.

Dharmakirti Joshi, chief economist at Crisil, feels that lending rates could go up. With the ongoing transmission of RBI’s rate hikes, the nominal interest rates moved well above the pandemic levels across different market segments. As of March, the interest rates reached 2018-19 levels across most instruments in the money and debt markets and some bank lending rates.

"Reduction in domestic liquidity is further facilitating transmission of RBI’s rate hikes across market segments. Even at these levels, the transmission is not yet complete to bank lending rates. This suggests a further rise in lending rates as the transmission of the previous and current rate hikes progresses. Such an increase in borrowing is expected to moderate domestic demand and slow growth in this fiscal,” Joshi said.

By keeping the repo rate unchanged at 6.50% in its bi-monthly monetary policy announced today, the RBI has sent the signal that lending rates would not go up. But while the interest rates on retail home loans may not rise, the bias is still towards a rising interest-rate regime.

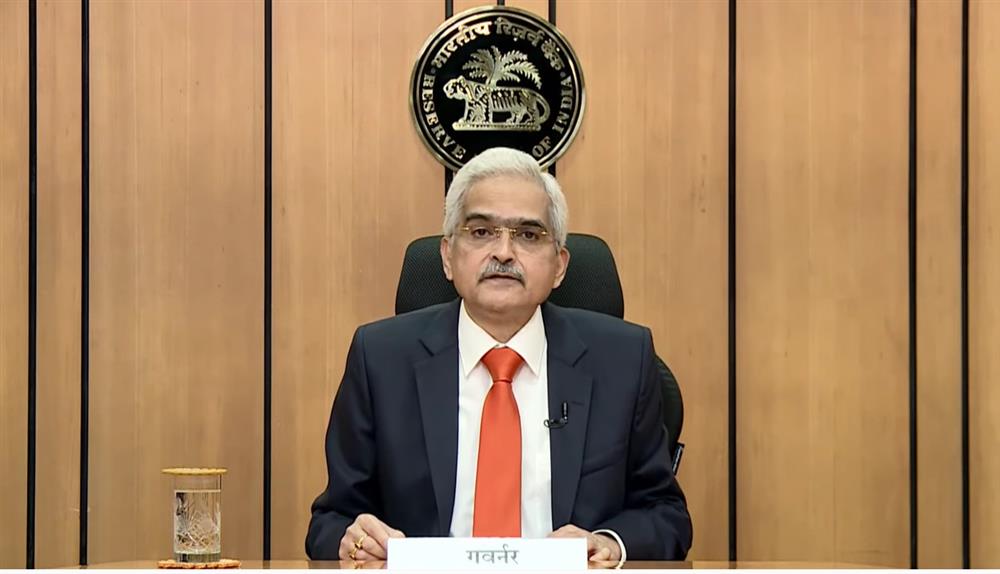

“The monetary policy actions taken since May 2022 are still working through the system. Accordingly, the MPC (monetary policy committee) decided to keep the policy rate unchanged to assess the progress made so far, while closely monitoring the evolving inflation outlook. The MPC will not hesitate to take further action as may be required in its future meetings,” RBI Governor Shaktikanta Das said in a statement after unveiling the policy.

The central bank thought it prudent to pause and assess the full impact of its rate hikes since May 2022. The interest rates on short-term borrowings like overnight call money rates increased by 300 basis points at the end of March 23 over the last year. The liquidity was clearly getting tighter and bank deposits were not growing as much as loan growth after economic activity resumed in the post-Covid period. The regulator said that the rate hikes that it had implemented from May 2022 were still taking effect.

“If I have to characterise today's monetary policy in just one line…it's a pause, not a pivot,” Das told reporters after the policy announcement.

Abheek Barua, chief economist at HDFC Bank, believes that short-term rates could remain under pressure. "Going forward the RBI could go for "the higher for longer" narrative - staying on an extended pause in FY24 while tightening liquidity conditions. Therefore, short-term rates could remain under pressure over the coming months. For the 10-year yield we could see some pressure return once the governments' borrowing program kicks in and a range of 7.20-7.30% is likely in the first quarter.

The policy has been effectively tightened by 290 basis points in the past year – a 250-basis point increase in the repo and a 40-basis point increase when the standing deposit facility (SDF) was introduced. Concurrently, the overnight call money rates have also increased by over 300 basis points between March 2022 and March 2023. Unlike the US Federal Reserve which hiked rates by 450 basis points, the RBI rate tightening cycle, though abrupt initially, was gradual and calibrated in the last 10 months.

“We have increased the policy repo rate cumulatively by 250 bps in the last 11 months starting May 2022. This was preceded by the introduction of the SDF at a rate 40 bps higher than the fixed rate reverse repo. Thus, the effective rate hike since April last year has been 290 bps. These increases have been fully transmitted to the overnight weighted average call money rate (WACR), the operating target of monetary policy, which has gone up from a daily average of 3.32% in March 2022 to 6.52% in March 2023,” Das said.

The RBI is assessing how banks have transmitted these rate hikes and what the impact would be in the banking system. “It is now necessary to evaluate the cumulative impact of these rate hikes. Under these circumstances, we have to be extremely prudent in our actions. We have always been very watchful and have adopted a calibrated and balanced approach and will continue to do so,” Das said.

There are other theories floating around on the rationale that would have weighed on the minds of the six-member rate-setting MPC. These range from growth concerns to liquidity issues, government borrowing programme and allowing transmission of policy hikes to completely settle in. The collapse of US tech-lender Silicon Valley Bank (SVB) due to asset-liability mismatch in a high interest-rate regime also could have prompted a reaction.

Since monetary policy usually impacts the real economy with a lag of 3-4 quarters, the full impact of the transmission is expected to slow growth and moderate inflation in FY24, analysts said. The RBI has, however, elevated the GDP growth forecast by 10 basis points to 6.5% and cut its inflation projection to 5.2% from 5.3% in FY24 while keeping the repo rate unchanged in the first credit policy announcement of the fiscal.

With the pause, the RBI has projected lower inflation following expectation of a record rabi harvest which bodes well for easing of food price pressures. There is already evidence of a correction in wheat prices in March on supply-side interventions by the government and global commodity prices have also softened. For the first quarter, the RBI has projected inflation at 5.1%; in the second quarter and third quarter at 5.4%; and in the fourth quarter at 5.2%.

Some economists expressed surprise at the RBI’s GDP growth and inflation projections. “We expect that growth could be lower at 6% this fiscal while there are upside risks to the RBI’s inflation forecast, especially given the impending risks around oil prices and the performance of monsoons,” said Barua.

A ’pause’ in repo rate has come at a time when there is fear of a recession in many parts of the world and inflation has stayed stubborn. The oil prices have also started surging again, after members of the Organisation of the Petroleum Exporting Countries (OPEC) and its allies announced that they would cut production.

The ‘pause’, however, is a temporary action and the RBI has kept the door open for further rate increases. Noting their “readiness to act if the situation so warrants”, Das has emphasised that the repo rate hike has been paused only for this meeting.

“The MPC has taken a very balanced and nuanced view which ensures stability in the status quo situation while not committing to the future path that will be data-driven,” said Madan Sabnavis, chief economist at Bank of Baroda.