The pause in interest rates is tactical and further rate hikes can’t be ruled out as the fight against inflation is far from over. That seems to be the thinking of the monetary policy committee (MPC), which met during April 3 - 6 to decide on the repo rate.

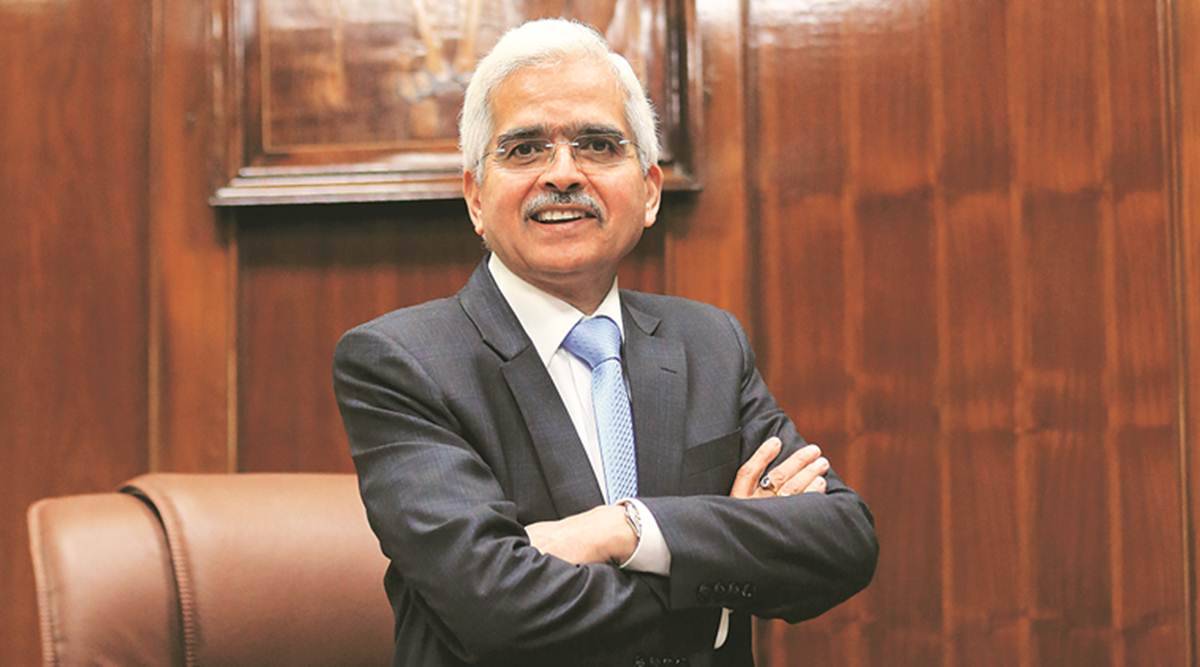

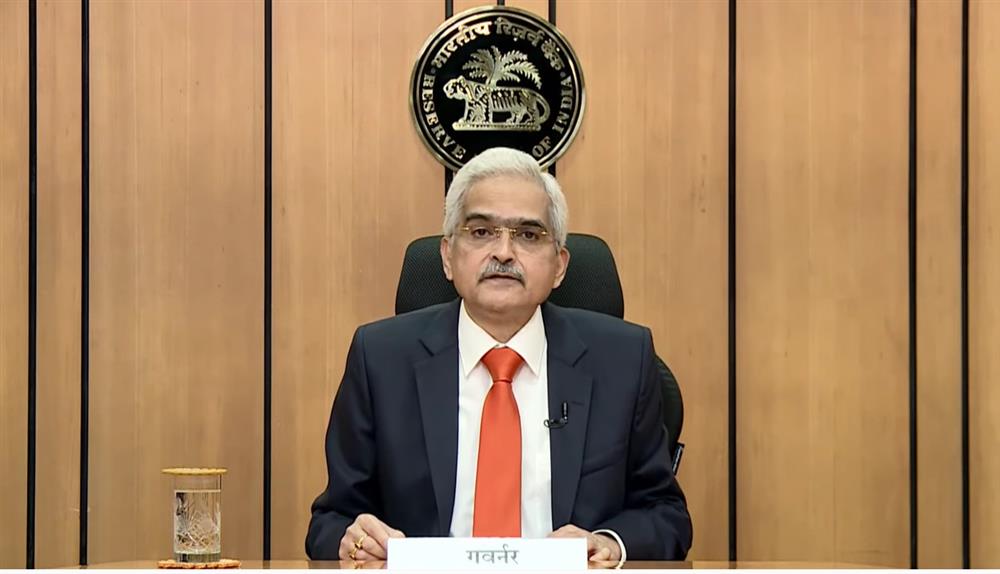

RBI Governor Shaktikanta Das was of the view that the cumulative impact of the monetary policy actions over the last one year “is still unfolding and needs to be monitored closely”.

The focus to bring about a durable moderation in inflation would continue while at the same time giving “ourselves some time to monitor the impact of our past actions”. A tactical pause was the logical outcome of this.

"This is a tactical pause and not a pivot or a change in policy direction. We will continue to monitor all incoming information and undertake a forward-looking assessment of the evolving economic outlook and stand ready to act, should the situation so warrant. Our fight against inflation is far from over and we have to continue with our efforts to bring down inflation closer to the target over the medium term,” Das said, as per the MPC minutes released today.

The RBI surprised the market when it announced in the first bi-monthly monetary policy of FY24, that the policy repo rate under the liquidity adjustment facility (LAF) would be kept unchanged at 6.50%. This ‘pause’ came after the RBI announced six back-to-back rate hikes to take the repo rate up by 250 basis points since May 2022.

In the latest bi-monthly monetary policy, the rate-setting MPC also kept the standing deposit facility (SDF) rate unchanged at 6.25%, while the marginal standing facility (MSF) rate and the Bank Rate were also untouched at 6.75%.

Inflation for 2023-24 is projected to soften, but the disinflation towards the target is likely to be slow and protracted. The projected inflation in Q4:2023-24 at 5.2 per cent would still be well above the target, Das noted.

The RBI did not change its policy stance and remained focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth.

In the MPC meeting's minutes, Das said, "Since the last meeting of the MPC in February 2023, the global economic environment has changed dramatically."

He added, "While issues of geopolitics and high inflation continue to impact the outlook, the emergence of banking sector turmoil on both sides of the Atlantic and the sudden announcement of oil production cut by the OPEC+ countries have rendered the global outlook even more uncertain. Global inflation is easing but at a tardy pace. Central banks face a runway which is becoming narrower and bumpy for soft-landing."