India’s retail inflation spiked to a 15-month high of 7.44% in July, breaching the Reserve Bank of India’s upper tolerance limit of 6% for the first time in the current fiscal.

The much higher-than-expected consumer price index-based inflation was led by a surge in prices of tomatoes, vegetables and other food items.

In fact, the consumer food price index in July surged to 11.51%, the highest since October 2022. This was 4.55% in the preceding month and 6.7% a year ago. Pulses, cereals, and spices saw double-digit inflation rates.

In June, the consumer price index-based inflation stood at 4.87%.

Retail inflation stood at 6.71% in July 2022 and the previous high was recorded at 7.79% in April 2022.

In July of this year, the annual inflation in the vegetables basket was at 37.44 per cent, spices at 21.63%, pulses and products at 13.27% and cereals and products at 13%. Vegetables have a 6.04% weightage on the overall retail inflation.

The food and beverages segment together contribute about 54% of the overall CPI.

The rate of price rise in oils and fats segment, however, declined 16.8%. The inflation in meat and fish, egg and fruits was in lower single digit, according to the data released by the National Statistical Office (NSO).

The data for food prices for early August 2023 is not very promising. Analysts expect the headline CPI inflation to print above the 6.5% mark in August before cooling off.

“Given the CPI inflation print for July 2023, the monetary policy committee’s (MPC) revised forecast for inflation for Q2 FY2024 of 6.2% appears to be at risk of being overshot, as the vegetable price shock may not reverse adequately before the next harvest. Moreover, rainfall has been deficient in August so far, which is likely to put upward pressure on food prices, amid the lags in kharif sowing across some crops,” said Aditi Nayar, chief economist at rating agency ICRA.

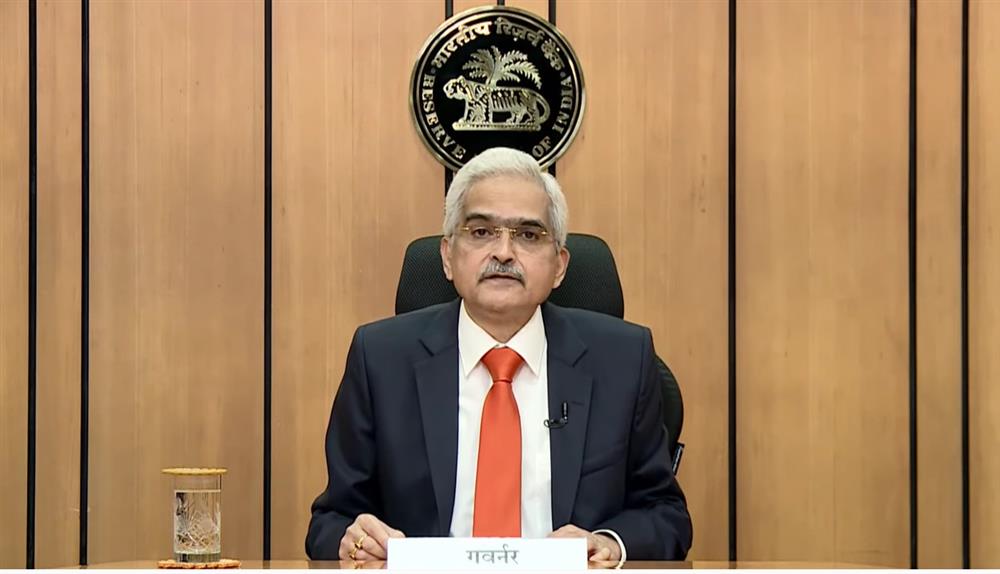

Will the Reserve Bank of India (RBI) go for a rate hike as the MPC had emphasized the need to be ready to act appropriately to ensure that the effects of shocks do not persist?

“The bar for a rate hike would be quite high. In our view, inflation would need to persist above 6.0% for at least two quarters, amid transmission of pressures to core inflation, to set the stage for a rate hike,” said Nayar.

Meanwhile, the trade data released by the commerce ministry showed merchandise exports contracted for a sixth consecutive month in July, by 15.9% year-on-year to $32.25 billion. Imports declined for a seventh month in a row, by 17% to $52.9 billion, leading to a trade deficit of $20.7 billion.