BANKS

UCO Bank’s record quarterly profit in 80-year life

UCO Bank’s Q3 net profit up 110.37% YoY to Rs 652.97 crore; record profit driven by lower bad loans, higher recovery from written off accounts and better loan pricing.

UCO Bank’s Q3 net profit up 110.37% YoY to Rs 652.97 crore; record profit driven by lower bad loans, higher recovery from written off accounts and better loan pricing.

Kolkata-headquartered UCO Bank reported its highest-ever quarterly profit. The 80-year-old bank’s net profit rose 110.37% year-on-year to Rs 652.97 crore for the quarter ended December 2022, driven by lower bad loans, higher recovery from written off accounts and better loan pricing.

In the year-ago quarter, the state-owned bank had posted a net profit of Rs 310.39 crore.

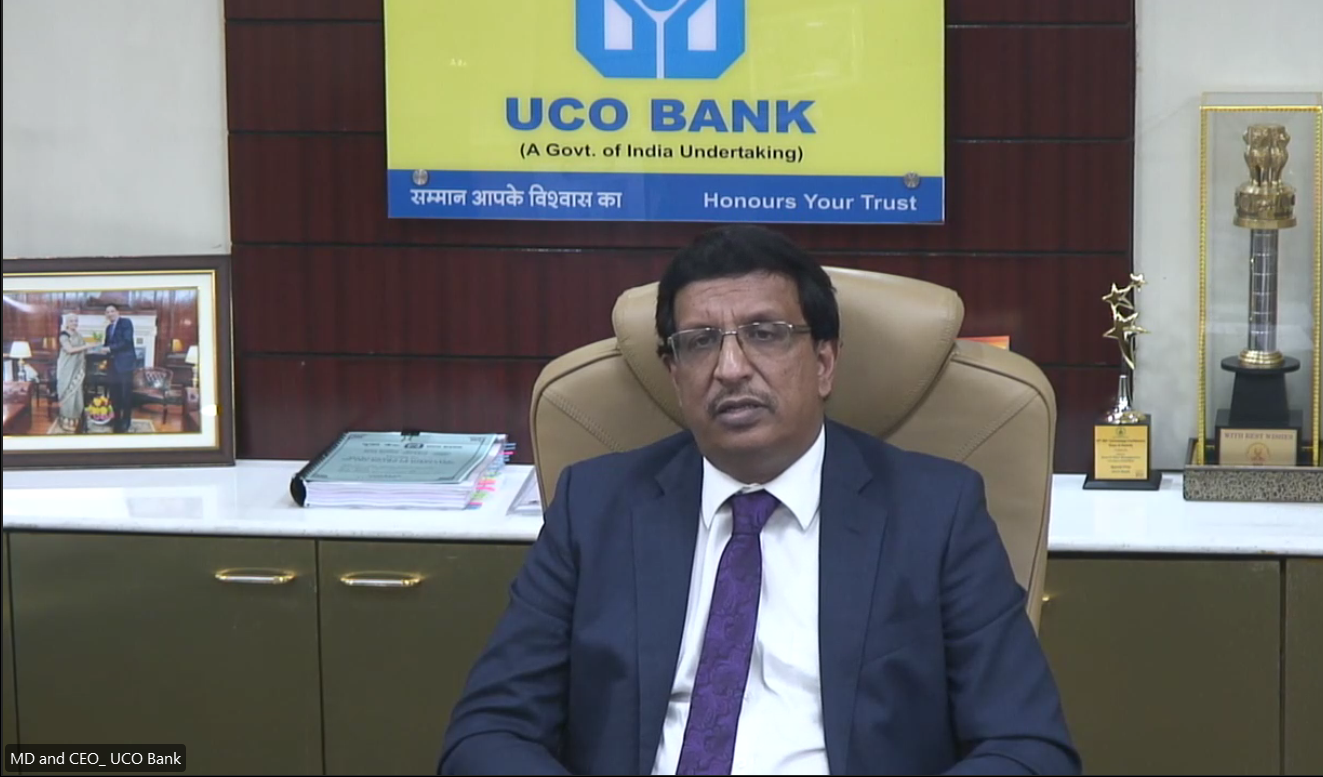

“The profits are the result of better pricing power as 45% of our loans are repo-linked. The asset quality has also improved significantly with the bank reporting just Rs 1,500 crore of fresh bad loan additions during the nine-month period of this fiscal compared to Rs 6,000 crore a year ago,” said UCO Bank managing director and chief executive officer Soma Sankara Prasad.

The bank’s net interest income (NII) rose 10.74% to Rs 1,951.87 crore in the December quarter due to a healthy growth in the loan book and improved yield on advances with a rise in interest rates. NII for the fiscal third quarter also includes an exceptional interest income due to recovery of Rs 200 crore from the Air India account.

Net interest margin for the December quarter was at 2.99%, up from 2.84% in the preceding quarter. However, it was lower than the year-ago period where it stood at 3.03%.

"We expect the NIM to stabilise at around 3% level in the next few quarters," Prasad said.

On the asset quality front, gross non-performing assets (NPA) ratio declined to 5.63% (Rs 8,506.08 crore) as of 31 December 2022 as against 8% (Rs 10,042 crore) a year back.

Net NPA ratio improved to 1.66% from 2.81%.

The bank recovered Rs 458 crore from written off accounts.

The bank’s bad loan provisions were 61% lower at Rs 220 crore versus Rs 565 crore a year ago. Provision coverage ratio improved to 93.58% from 91.3% a year back.

The bank’s loan advances grew 20.35% to Rs 1,51,059.08 crore, with the corporate portfolio increasing by 30% on account of infrastructure spending by the government. "We see good demand from both the corporate and retail side and expect this to continue in the fourth quarter," said Prasad.

Total deposits grew 11.14% YoY to Rs 2,43,169 crore. CASA (current account savings account) comprised 38.93% of the total deposits of the bank.