Lakshmi Vilas Bank (LVB) promoter KR Pradeep is an angry man. He describes the Reserve Bank of India's proposal to merge the Chennai-based bank with DBS Bank as "smelling of injustice". Preparing his reply to the regulator, he says, "we can't have zero price for LVB shareholders".

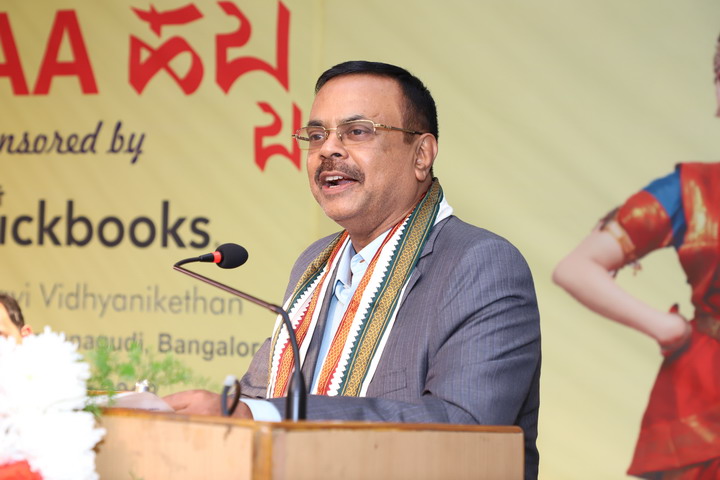

In an interview with Indianbankingnews.com Editor-in-Chief Sibabrata Das, Pradeep talks about the options the RBI could explore including the delisting of LVB or allowing its shareholders to participate in capital raising alongside DBS. He also opens up about the non-performing assets (NPAs) that led to the sinking of the bank.

Iam not going to make any objection as the RBI has decided on DBS. The Singapore-based group has very strong systems and Lakshmi Vilas Bank (LVB) badly needs capital. But I am going to suggest to the RBI that it should give a fair deal to the shareholders of LVB. The bank shouldn't be given free of cost to DBS. The deal should not be free but fair.

The easiest and the best route should be to get the valuation done. Based on that, we would get paid for our shares. We are not bothered about who does the valuation. We have full faith in the RBI. It has no vested interest in, or leanings to, either DBS or LVB. It can get anybody as an independent valuer.

DBS can take ownership of the merged entity and run it. The LVB shareholders can be allowed to participate in the capital raising. DBS can pump in Rs 2,500 crore, and we can bring in money. There can be a three-year lock-in before listing. The process and outcome can be decided by the RBI. We will have no objection to that.

We wish to be a shareholder, with DBS driving the operations and the business. LVB can continue as a listed entity, and DBS can have 74% stake in it. The Rs 2,500 crore that they are talking of bringing in can be infused as new capital in their acquisition.

The RBI as the regulator has to look into the interests of the depositors, creditors and the bank. There is no disputing that. But they should also have something for the shareholders; it can't be a whole zero. If DBS wants 100% ownership and not a 74% FDI (foreign direct investment) entity, then they can opt for the open-offer route as per SEBI's (Securities and Exchange Board of India) norms for delisting. This will be a more open process than deciding to give LVB to DBS without any valuation done, and this will also allow the shareholders to get what is due to them. We are asking RBI for valuation and not charity.

LVB requires capital and DBS is offering that solution. As for our NPAs, we have made almost 80% provisioning against that. Liabilities are paid for. We have even paid for our bond interest in September, i.e. two months back. RBI should strike a fair balance between the existing shareholders of LVB and the acquirer.

There can't be zero price for 563 branches and three million depositors that DBS gets through LVB. One lakh of our depositors are shareholders. If they are dissatisfied, they can migrate their deposits. The big oil today is data. And we have customers.

DBS has been here since 1994 and their balance sheet is much smaller than LVB. They have just 34 branches. It would have taken them decades to build a branch network as large as ours. There can't be a zero price for all this.

The capital infusion they are doing is for the growth of the business. The shareholders aren't getting anything. They should be voluntarily agreeing for a valuation. Banking is relationship-oriented and customer-driven. Perception is important for them, and they shouldn't be looking like predators. DBS has made several acquisitions, including one in Taiwan. They should use those yardsticks and do a valuation.

That the bank's position has been deteriorating is an accurate statement to make. Deciding the remedial measures is in the domain of the regulator. If I agree or disagree, it doesn't make any difference. What we are saying is that the shareholders' interest should also be protected.

If you are to get a bulk investor, the RBI needs to approve. We needed large capital and for that we had to look at strategic investors. We have taken investors to the RBI, but they didn't approve of the fit. Nevertheless, we raised Rs 800 crore via rights issue in 2018 and Rs 460 crore in 2019.

We got India Bulls, which had Rs 20,000 crore capital, to come in. But the RBI rejected it and then immediately we were put under prompt corrective action (PCA), which restricts the normal business activity of a bank. We had a Rs 500-crore rights issue and then a follow-on issue of Rs 1,000 crore. We got moving on Clix Capital and the Clermont Group, and a deal was in the horizon until the RBI announced the merger proposal with DBS.

We are only saying that the shareholders' wealth is being given away free by using a regulatory power. There was no run on the bank, no risk of increased lending, no crisis, and still the RBI used its extraordinary regulatory powers to come out with a merger proposal without any bidding. The boards of both the banks should have dealt with the issue and worked for the mutual interests of the banks. The regulatory benevolence has gone to the greedy and not the needy.

The AGM incident indicated that the board needed to be reformed. The RBI's role was to appoint a board of their choice, but it shouldn't have gone for a merger proposal. For a cycle theft you can't give capital punishment.

Our NPA cycle has already peaked, and the RBI should have given us more quarters to sort things out. We are a bank catering to the mid-segment of the society. The small and medium enterprises have business cycles and they come out of their problems in cyclic phases. We expected nearly 50% of the Rs 3,700-crore provisions to be reversed in a couple of years. This would unduly benefit DBS if the scheme of amalgamation sails through.

It was a clean case of NPAs. The bank was not mis-run nor was it a victim of fraud. The upper limit of our loan to a single entity was Rs 200 crore, and we had a very diversified portfolio. We participated in consortium loans to groups like Reliance Home Finance, CCD, Altico, and IL&FS. These loans became problematic. Our peak NPA was Rs 4,000 crore, spread over sectors like steel and infrastructure.

That is a fair assumption to make, but we will plead with the regulator for a fair decision. Although the RBI's decision smells of injustice, it has opened a window for making objections and suggestions to their scheme of amalgamation. We will make our suggestions and hope that the apex bank considers our points of view favourably.