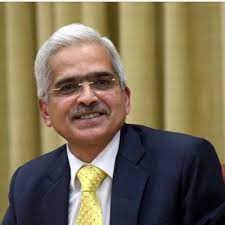

The Reserve Bank of India (RBI) will take strict action against regulated entities who resort to strong-arm tactics to recover loan dues from their borrowers, governor Shaktikanta Das warned.

All financial institutions need to desist from harsh recovery methods and keep a strict control over their recovery agents. Calling up at odd hours or using foul language is unacceptable, Das said.

The RBI governor assured that the central bank is paying ‘serious attention’ to such happenings to ensure necessary action is taken to curb such activities.

“We have received complaints of customers being contacted by recovery agents at odd hours, even past midnight. There are also complaints of recovery agents using foul language. Such kind of actions by recovery agents are unacceptable and pose reputational risk for the financial entities themselves," Das said while speaking at Modern BFSI Summit 2022 organised by the Financial Express.

Das said that such actions are generally from unregulated entities but there are complaints from regulated entities as well.

“We have taken serious note of such instances and will not hesitate to take stringent action in cases where regulated entities are involved. Such complaints against unregulated entities will have to be taken up with appropriate law enforcement agencies," the governor added.

The RBI recently set up a Committee for Review of Customer Service Standards in the RBI Regulated Entities (REs), which would inter alia review the emerging and evolving needs of the customer service landscape, especially in the context of evolving digital financial products and their distribution, and suggest measures for strengthening the overall consumer protection framework.

On digital lending, Das said the Reserve Bank will soon come out with guidelines to regulate it. “The recommendations of the RBI-working group on digital lending are in very advanced stage of examination and the guidelines will be issued very shortly.”

Last year, the RBI had set up a working group to study issues surrounding digital lending apps and suggest regulations. In November, the group proposed stricter norms for digital lenders, including bringing digital lending apps under a verification process by a nodal agency.

The issue has come to the fore after some borrowers committed suicide following harassment by recovery agents of banks as well as loan-lending apps.

Last week, Das had said that details of registered lending apps are available on the central bank's website. A working group set up by the RBI had found that 600 illegal lending apps existed between January 1, 2021 and February 28, 2021. Around 2,562 complaints against digital lending apps had been received between January 1, 2020 and March 31, 2021.