Personal loans extended by banks and non-banking financial companies (NBFCs), which have seen a rising trend, have come again come under the radar of the Reserve Bank of India (RBI).

Raising a red flag against the rising unsecured loan portfolio of lenders, the RBI on Friday asked scheduled commercial banks and NBFCs to strengthen their risk management system and take suitable measures to address stress on account of collateral-free personal loans.

Pointing out that certain components of personal loans are recording very high growth, the RBI indicated that it will step in with prudential regulations to limit such unsecured lending should lenders remain reckless as it raises the risk of bad loans.

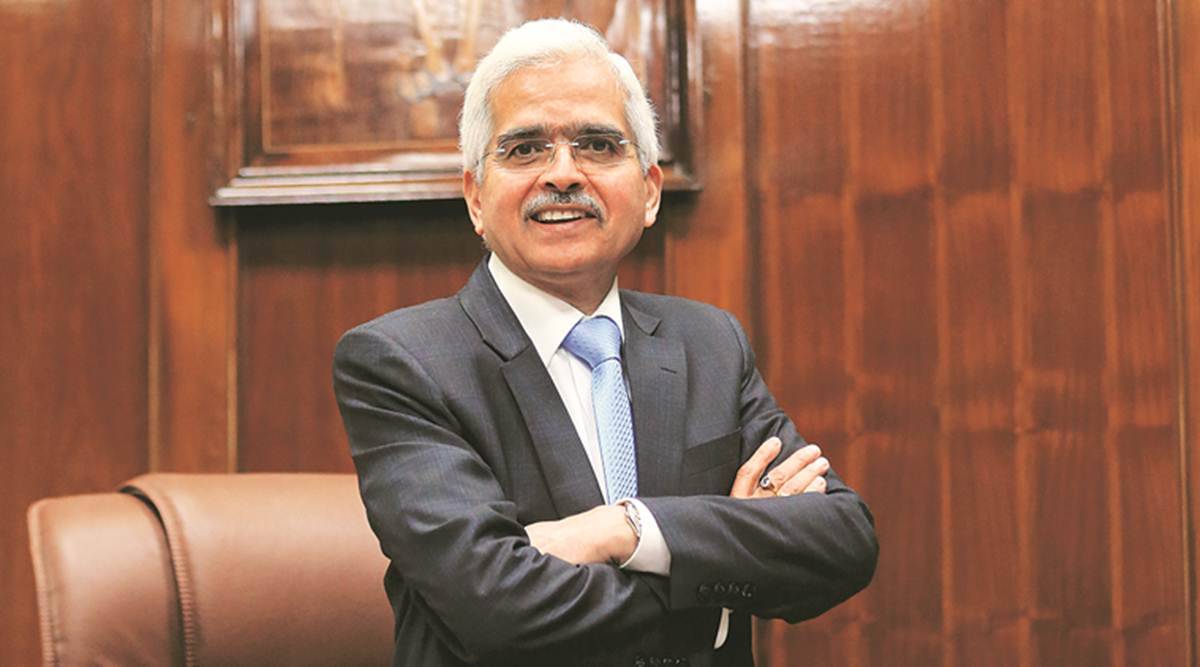

"These are being closely monitored by the Reserve Bank for any signs of incipient stress. Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest. The need of the hour is robust risk management and stronger underwriting standards," RBI Governor Shaktikanta Das said in his monetary policy statement on Friday.

The total credit to the segment stood at Rs 47.70 lakh crore in August 2023 versus Rs 36.47 lakh crore a year ago. Credit to the sector from April 2023 to August 2023 grew to Rs 47.70 lakh crore, up 16.8% from Rs 40.85 lakh crore.

In April, the RBI had cautioned lenders over their rising unsecured loan portfolio, including personal loans, credit cards, small business loans and microfinance loans.