The Reserve Bank of India (RBI) has warned against the surge in top-up housing loans and pointed out that certain banks and NBFCs have not followed the regulatory requirements related to them.

The central bank has asked all lenders to review such practices, keep a check on the borrower’s end-use of top-up loans, and take remedial action.

The regulator has also flagged concerns on gold loan top-ups. This facility is offered to borrowers when the gold prices tend to move upwards.

The high growth in top-up loans has led to the fear that some borrowers may be using money for speculative investment, including putting it in the stock market. More retail investors have turned to the stock market and many have been engaged in highly speculative investment like future and options.

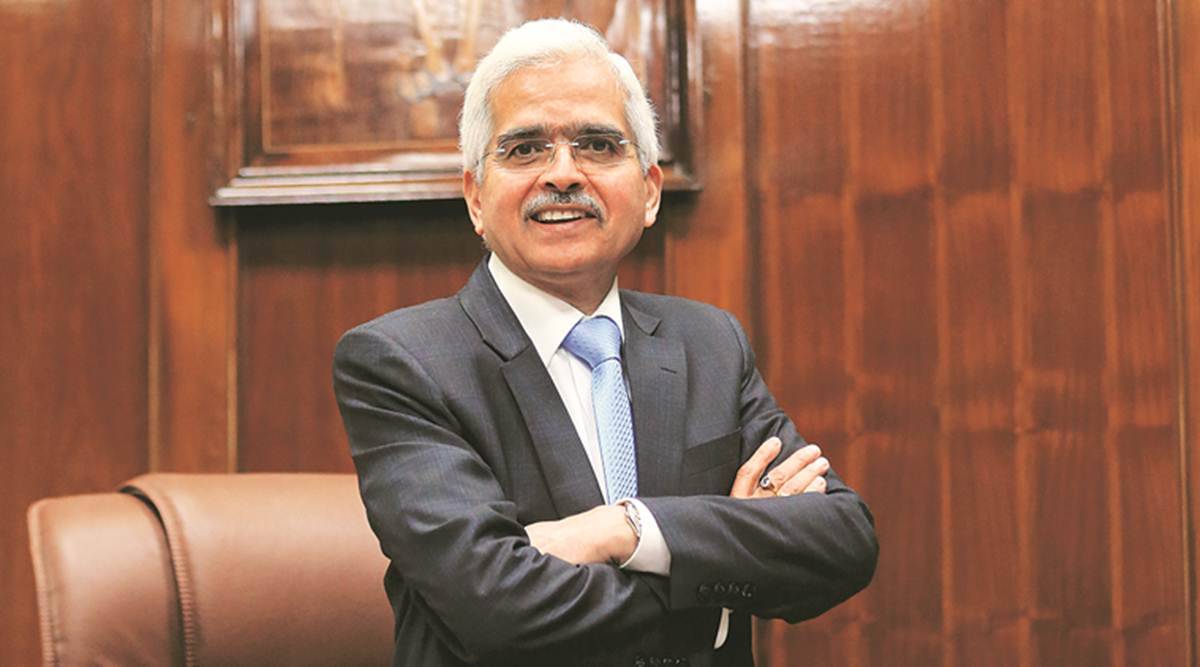

“Our attention has been drawn to home equity loans, or top-up housing loans as they are called, which have been growing at a brisk pace. Certain banks and NBFCs (non-banking financial companies) have also been offering top-up loans on other collateralised loans like gold loans. It is noticed that the regulatory prescriptions relating to loan to value (LTV) ratio, risk weights and monitoring of end-use of funds are not being strictly adhered to by certain entities. Such practices may lead to loaned funds being deployed in unproductive segments or for speculative purposes. Banks and non-banks are well-advised to review such practices and take remedial action,” RBI Governor Shaktikanta Das said during the monetary policy committee (MPC) meeting briefing.

Lenders usually give a home loan top-up when the value of the house has gone up. The LTV ratio allows the borrower to become eligible for a higher loan amount on the same property.

The regulatory requirements in top-up housing loans are not being followed by certain entities and it is not a system-level problem, Das said, adding that such cases are being dealt at the supervisory level bilaterally.

Top-up loans are those which a borrower can draw down over and above an existing personal or home loan.

In most cases, the end use of top-up loans is not defined. While these loans are often taken for specific purposes, such as house repairs and renovations, the loan amount is credited directly to the borrower’s account. This contrasts with home loans, where the loan amount is directly credited to the seller’s account.

“The RBI’s concern is valid, as using top-up loans for investments in volatile assets like equities or other speculative investments can be very risky for borrowers and increase the chances of default. This can also lead to an increase in non-performing assets (NPAs). Therefore, lenders should be very vigilant about the intended use of top-up loans and may need to establish a mechanism to ascertain the actual use of these loans once they are disbursed to the borrower,” said Andromeda Sales and Distribution Co-CEO Raoul Kapoor said.

Anil Gupta, Senior Vice President and Co-Group Head – Financial Sector Ratings, ICRA Ltd, supports the RBI on flagging concerns about top-up loans. “With increased activity levels in the top-up loan segment, RBI’s caution to lenders on calibrating underwriting norms and closer monitoring of the end-use is a step in the right direction. Such loans not only raises concerns on overleveraging but it also raises suspicion on the quality of such borrowers, as they may also use such top-up loans to service the existing loans,” he said.