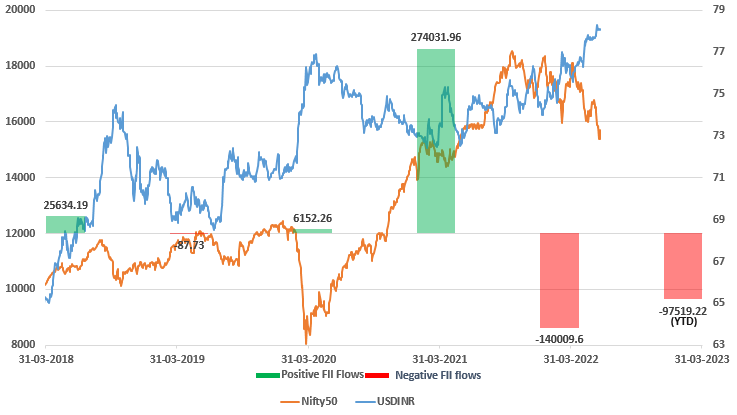

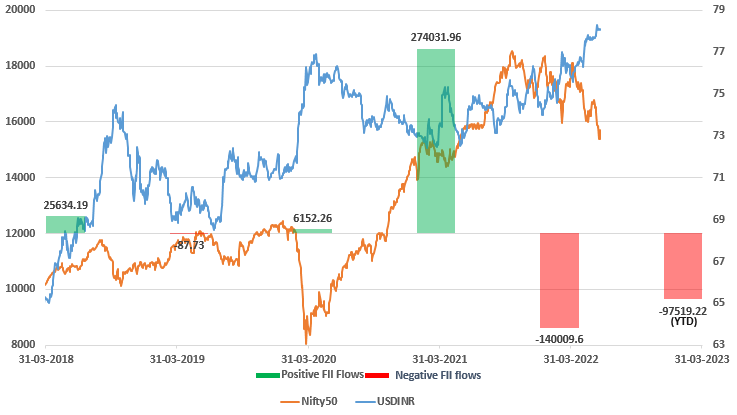

Indian rupee is trading at an all-time low, hovering around 80 to a dollar. Since October of last year, FPIs (foreign portfolio investments) have sold nearly $37 billion in equity and debt markets and there has been significant unwinding of the carry trade. It is hard to estimate the actual amount of carry trade unwinding as no comprehensive data is available but based on anecdotal evidence of let us say the Reserve Bank of India’s (RBI) forward book, it could have been well above $10-15 billion.

A simple way to track the rupee is to focus on its drivers. The two factors which cause a trend in the rupee are: capital flows and carry trade flows. Capital flows are captured in the balance of payment data, viz., FDI (foreign direct investment), FPI, corporates raising foreign currency loans, trade credits and NRI (non-resident Indians) deposits.

However, balance of payment (BOP) does not capture the carry trade flows, as they happen via derivatives and not cash. Therefore, carry traders always try and anticipate the direction of the capital flows and also their quantum and accordingly they place their bets. If they anticipate FPI flows and other kinds of foreign currency flows to increase, due to positive global risk environment, like it was the case between May 2020 and end of 2021, then carry traders tend to increase their long rupee bets. But when they expect outflows, especially FPI outflows, like it is this year, they reverse their bets and go Long USD. Therefore, carry traders can be thought of as amplifiers of the impact of capital flows.

Interestingly, the rupee is not just driven by capital flows and carry trade. There is one more major player who dictates how far and how fast the currency will travel. It is the RBI. The chart below shows, how the role of RBI in rupee has changed over time.

Over the last eight years, the RBI has become a major player in the market. Massive accumulation of foreign exchange reserves has allowed the RBI to intervene on both sides of the market, using spot, futures, forwards and NDF, to reduce volatility. The RBI targets to keep the rupee a median performer and also its volatility low. The following three charts will give u a glimpse of how the RBI has accumulated the massive reserves over the last few years and how they using it. It will also show, that the rupee has been kept right in middle when we compare it against a basket of currencies

The path forward will be dictated by how long can the Long USD trend last. As long as USD continues to strengthen due to Fed’s hawkishness and fear of global recession, USDINR can continue to move higher, but a slow speed, guided by RBI. We could see levels of 80.50/81.00 over the next medium term.

8

A.999

A.999

A.999

A.999